Thought

Financing Sustainable Real Asset Investments: Drivers, Challenges and Solutions

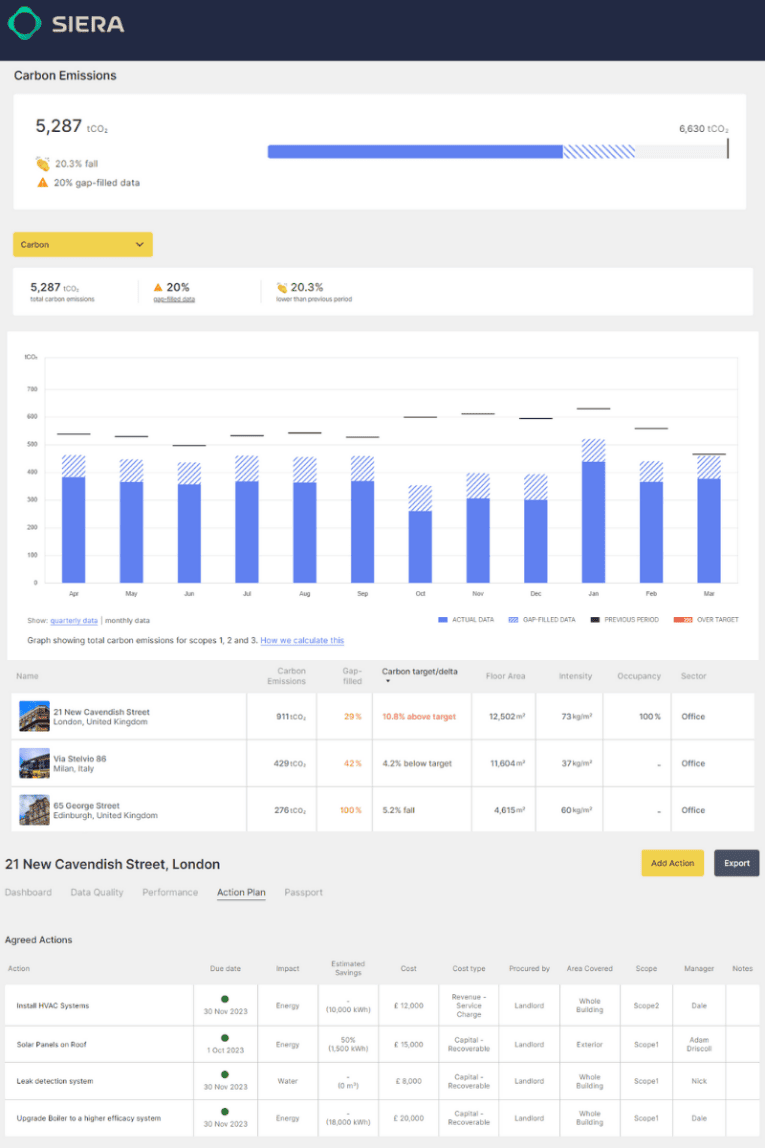

In the face of geopolitical upheaval and regulatory changes, funds that incorporate environmental, social, governance (ESG) and sustainability are witnessing remarkable growth. According to McKinsey Sustainability, private-market equity investors have launched more than 330 such funds over the past four years, with cumulative assets under management (AUM) soaring from $90 billion to more than $270 billion.

This begs the question: How come?

Turbulence breeds opportunity

The green industrial revolution and urgent shift towards a low-carbon, sustainable economy is an obvious driver for sustainability in real asset investments. Increasing adoption of UNSDGs and Net Zero Carbon climate commitments, innovative energy-saving solutions, and generational pressure for climate change are rallying cries for improved energy security, affordability, and sustainability.

And the potential for private capital to decarbonise real assets and invest in climate-resilient infrastructure and assets is immense. All this, despite geopolitical turbulence and economic uncertainty. In fact, the current financial environment is proving advantageous for first-mover real asset investors primed to finance climate-resilient portfolios free from red flags.

Governments are spearheading climate resilience

This remarkable surge in sustainable investment funds also underscores the growing enthusiasm and assurance surrounding sustainable investment opportunities. Governments and financial market participants across the globe are exhibiting a heightened interest in resolving the pressing issues of climate change and the energy crisis. So much so that dynamic regulatory changes are afoot both sides of the pond.

According to the 2023 Green Finance Strategy, the UK aims to become the world’s first net zero-aligned financial centre. The government predicts that ESG-focused AUM will surpass the asset and wealth management market. It’s meteoric rise from $2.2 trillion (2015) to $18.4 trillion (2021) and upwards to a projected $34 trillion (2026) in the UK alone brings this point home. However, for the UK to realise its ambition of becoming a leading growth hub for financial services and green industries, real asset investors must first harness the full potential of Sustainable Finance.

Meanwhile, the European Green Deal is mobilising more than €1 trillion in public and private funds towards a low-carbon economy in Europe. And the US is in hot pursuit with Biden’s Inflation Reduction Act. Allocating more than $400 billion to mitigate climate change in the US, a breathtaking $250 billion is already earmarked to upgrade, repurpose, or replace the country’s energy infrastructure.

Although the financial rewards of sustainable real asset investments are undoubtedly promising, Rome wasn’t built in a day! Real asset investors must navigate several shared obstacles to secure valuable risk-adjusted returns for long-term investment.

Five challenges facing real asset investments for sustainable funds

1. Complying with sustainable regulations and voluntary disclosures

Compliance with legislation such as the European Union’s SFDR (Sustainable Finance Disclosure Regulation), combined with rules around carbon and energy performance certifications (EPCs), are strong drivers and indicators for capital-raising and asset transactions.

And although PRI (Principles for Responsible Investment), TCFD (Task Force on Climate-related Financial Disclosures), GRESB, Net Zero Alliances, and corporate ESG targets provide frameworks to advance real asset sustainability, aligning and complying with sustainable regulations and disclosure regimes is easier said than done.

This is because practical implementation of these frameworks depends on high-quality data collection, accuracy, resource allocation, and the burden of self-reporting sustainability performance.

Unfortunately, the absence of standardised metrics and reporting can create obstacles in accurately collecting this data to assess the sustainability performance of varied investments across diverse sectors and regions. Manual data processing further complicates the evaluation of sustainability performance for global funds and large portfolios. And although accurate and reliable data for disclosures is crucial for credibility and compliance, self-reporting sustainability performance can add additional strain on limited personnel and financial resources.

Staying current with evolving regulations, standards, and disclosures is also essential for investors to adapt, mitigate legal and reputational risks, and stay competitive within the fast-moving sustainable real asset investment sector.

Furthermore, investors need to align corporate sustainability strategies and disclosures with stakeholder expectations (clients, shareholders, and regulators). This can create competing interests, impacting asset value, revenue streams, and operational practices.

2. Consistently scoring sustainability performance for real asset investments

Scoring sustainability performance for real asset investments in a consistent manner presents significant challenges for investors. Although sustainability scoring methodologies like BREEAM, LEED, EPC, Energy Star, and NABERS are invaluable when assessing the sustainability performance of real assets, implementation of these frameworks can be inconsistent and difficult to compare. This is especially so when portfolios straddle different geographies and jurisdictions. This can make comparative sustainability asset performance difficult to achieve.

Added to this, obtaining, maintaining, and coordinating different certifications can be challenging and costly, self-reporting and subjective assessments can run the risk of inaccurate data, and incorporating prerequisite sustainability features can involve higher upfront costs.

Real asset investors must grapple with these challenges to navigate the complexities of sustainability scoring methodologies, certifications, and associated costs. Balancing the need for reliable and comparable data while considering the financial implications of incorporating sustainability features calls for careful consideration and strategic decision-making.

This, of course, underscores the importance for real asset investors to stay informed, to seek real asset sustainability expertise and software, and carefully evaluate the trade-offs involved in pursuing sustainable real asset investment strategies.

3. Balancing financial viability with feasibility for net zero real assets

Real asset investors also face the challenge of balancing financial viability with feasibility when navigating CRREM and SBTi (Science-Based Targets initiative). Careful evaluation of costs and risk-adjusted returns is essential, while also considering the practical aspects of implementing sustainability interventions. The long-term return on investment may be a future objective beyond the hold period.

Although implementing interventions during building operations may present challenges, incorporating sustainability objectives into long-term strategies allows gradual progress towards desired outcomes. Real asset investors navigating CRREM and SBTi will reap the benefits of their proactive and forward-thinking approaches when it comes to achieving sustainable returns balanced against practical considerations.

4. Implementing Green Leases for sustainable real assets

Green Leases are comprehensive agreements that cover a wide range of environmental aspects and involve collaboration between landlords and tenants. Green clauses, on the other hand, are more specific provisions within tenancy agreements that focus on selected sustainability issues. These clauses can be incorporated into shorter-term tenancies and tend to be more flexible and easier to achieve.

Implementing the more stringent long-term Green Leases presents several challenges for real asset investors. Ensuring accurate tenant data, promoting adherence to sustainable practices, and mitigating reputational risks are among the key hurdles to overcome.

The main challenge lies in obtaining precise tenant data, specifically information on energy, water, and carbon consumption across real assets, funds, and portfolios. This data is crucial for assessing and improving sustainability performance. However, to achieve the desired outcomes of Green Leases, it’s crucial to consistently encourage tenants to embrace and effectively manage sustainable practices. Real asset investors must communicate effectively, foster strong collaboration with tenants, and establish robust monitoring systems to successfully implement Green Leases and accomplish related sustainability objectives.

Maintaining transparency and addressing any discrepancies between sustainability claims and actual performance are also vital steps to minimise reputational risk. In doing so, real asset investors can leverage Green Leases to drive sustainability and enhance long-term asset value.

5. Adding social value and restoring nature within real asset investments

Determining the most impactful ways to add social value and nature restoration within real asset investments depends on quantifying, tracking, and reporting on social impact. Addressing land-use planning and biodiversity conservation for nature restoration while balancing financial considerations with social and environmental benefits are key considerations.

According to The World Bank: “Nature-based Solutions (NBS) are becoming a key component in many investment projects in urban development, disaster risk management, natural resource management, transport, and water management.” NBS projects and financing commitments have surpassed $5 billion in the past decade alone.

Investors need to make careful plans, allocate precious resources, and engage all key stakeholders to assess the benefits and costs of NBS for climate resilience. The World Bank’s Guidelines for Project Developers outlines eight best-practice examples.

Five solutions to bridge the investment gap in sustainable real assets

1. Delivering risk-adjusted returns with material sustainability

By focusing on delivering risk-adjusted returns with material sustainability, investors can play a crucial role in bridging the investment gap for a faster transition to sustainability. Real asset investors can conduct rigorous due diligence to assess both financial risks and sustainability risks associated with potential projects. Integrating comprehensive risk management strategies and leveraging advanced analytics can help optimise investment decisions, enhance performance, and mitigate potential risks. By proactively addressing environmental and social risks, investors can also safeguard their risk-adjusted returns while driving positive sustainability outcomes.

Enhancing transparency and reporting practices is key to directing more capital towards sustainable real assets. Investors should advocate for standardised and comprehensive reporting frameworks to replace the current fragmentation.

By providing clear and consistent information on the financial and sustainability performance of their investments, investors can infuse confidence among stakeholders and bridge the trust gap in the market. This will enable them to attract a wider range of investors, including those with specific sustainability mandates.

2. Integrating ESG into investment discussions during real asset transactions

By considering ESG alongside financial analysis and due diligence, real asset investors can make more informed investment decisions. Actively engaging with stakeholders throughout the investment process helps address sustainability issues and opportunities, ensuring that investments align with sustainable objectives.

Integrating ESG criteria into investment strategies not only enhances financial performance, but also helps manage sustainability risks. It enables real asset investors to identify and prioritise sustainable projects that generate positive social and environmental impacts. This approach not only helps bridge the investment gap but also contributes to the overall transition to sustainable real assets.

3. Closing the language gap between ESG and real asset investments

Clearly articulating the financial implications of ESG factors, aligning sustainability goals with investment objectives, and integrating ESG metrics and reporting frameworks, like the CSRD (Corporate Sustainability Reporting Directive), into investment processes promotes stronger communication and mutual understanding between real asset investors, managers, and other stakeholders.

4. Integrating ESG into standardised real asset valuations

By integrating ESG into standardised valuations, real asset investors can better assess the value and risk profile of sustainable real asset investments. This means developing and adopting valuation methodologies that consider the financial impact of ESG performance, incorporating ESG criteria into property appraisals, and aligning valuation standards with sustainability objectives.