Sustainable finance is thriving

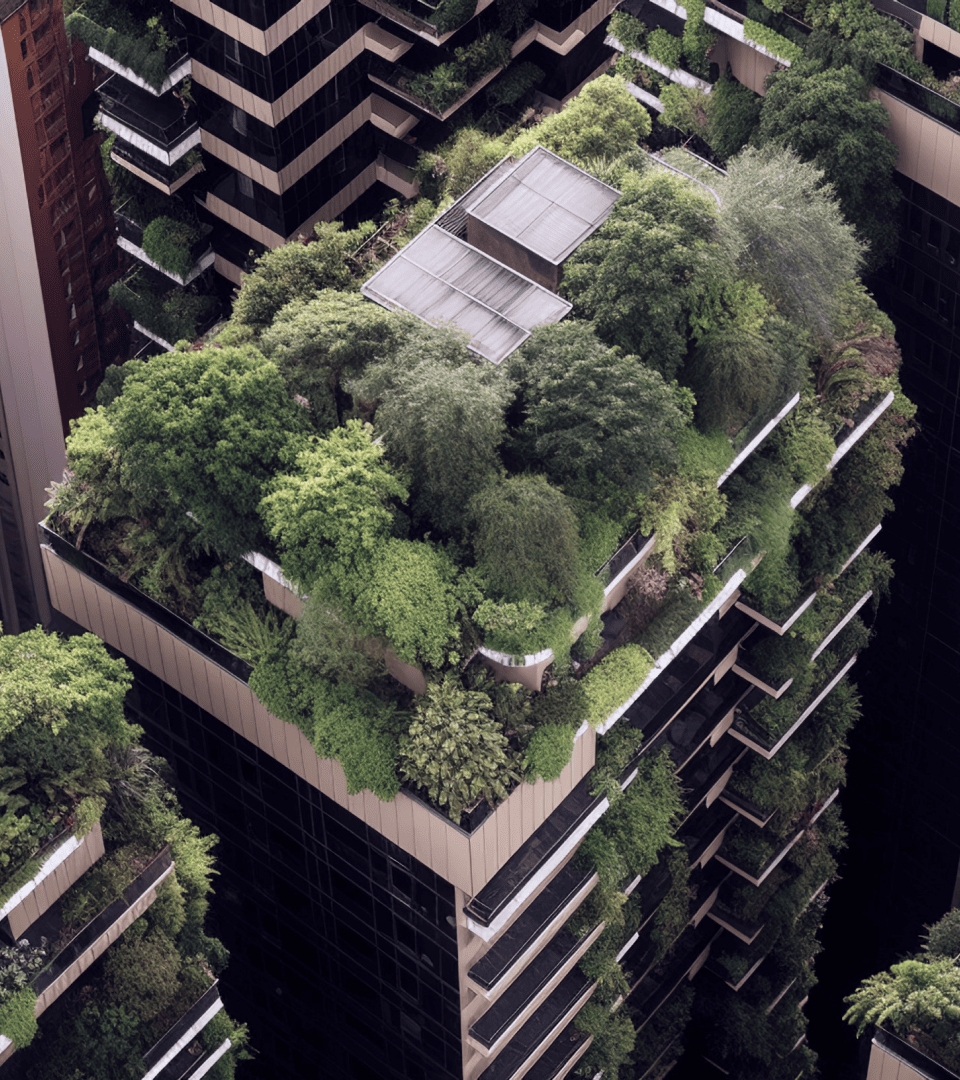

Embrace the future of real estate financing with our Sustainable Finance expertise, empowering your portfolio to thrive amidst evolving market dynamics.

Maximising Returns with Sustainable Finance

Drivers of Growth in Sustainable Financing

Decarbonisation is a driving force for the future of real asset investment. Buildings alone are responsible for almost 40% of global energy-related carbon emissions.

As the real asset sector pledges to decarbonise, crucial building renovations and transition projects face a notable financing gap. Join us in closing this financial gap and steering sustainable investments towards essential real asset decarbonisation.

Partner with us to unlock the true potential of your real asset investment portfolio, navigating the sustainable debt landscape strategically and ensuring financial success while driving positive environmental and social change.

safeguard your financial future

Achieving a Sustainable Future with EVORA Global

Lenders and investors are increasingly acknowledging the financial risks tied to sustainability, especially the impact of climate change on their debt portfolios. EVORA advocate sustainable debt practices, as a strategic approach to managing and mitigating these debt portfolio risks.

By integrating sustainability into due diligence, lenders can gain a comprehensive understanding of borrower and asset risks and opportunities, empowering more informed decision-making and empowered engagement. Join us in shaping a resilient and sustainable financial landscape.

OUR CRE8 Sustainability Principles

Strategies for Integrating Sustainability into Real Estate Debt

Adopt a systematic approach to sustainable commercial real estate debt. Our CRE8 Sustainability Principles are designed for a successful and sustainable approach to commercial real estate lending.

- Structure – establish governance practices, document processes, and assign roles and responsibilities.

- Standards – determine which standards align with your business and fund strategy

- Integration – integrate sustainability considerations into underwriting and due diligence stages.

- Tools – use tailored, bespoke tools that align with your business and sustainable debt strategy.

- Engagement – monitor borrowers progress against predetermined sustainability criteria throughout the loan term.

- Disclosures – have a structured reporting and disclosure process that encompasses sustainability.

- Evaluation - review and enhance your sustainable debt strategy and implementation to adapt to changing circumstances.

- Expertise – seek expert assistance, we have a successful record of supporting a variety of clients, including financial services companies, investment banks, and alternative lenders, in developing their sustainable real estate lending strategies.

Gain a Competitive Edge with EVORA as Your Guide

Our value-added services will ensure successful integration into your real estate debt programs, setting you apart in the market.