Thought

Five sustainability trends for the 2020s: what’s in store for real estate?

Upon entering the 2020s, which some dub ‘a decade for delivery’ to improve sustainability across the board, it is perhaps wise to consider the breakout trends that will carry forward. After all, a new year always inspires new endeavours. It provides a clean slate to readjust and redeliver, as well as a fresh opportunity to realign and build upon past achievements.

The 2020s may have a lot in store for everyone across the real estate space; so what should we be looking out for?

Net zero heroes

This commitment has been on the lips of government officials and real estate investors alike, marking a significant promise to achieve net zero carbon across the UK by 2050.

In September 2019, 23 of the UK’s leading commercial property owners have signed a commitment launched by the Better Buildings Partnership (BBP) to tackle the growing risks of climate change, pledging to decarbonise. Covering over 11,000 properties, this type of agreement is likely to inspire more companies throughout the next decade to also commit time and resource in the fight against climate change.

It is therefore expected that the dynamics behind climate strategy will shift in tow, with awareness of a pressing deadline introducing the need for a new radical mentality for rapid decarbonisation across a vast sector. The path to complete overhaul will not be simple, nor one that can be touched lightly, it will require serious engagement and in effect be one of the most major driving forces for change across the industry. Certainly, one to watch intently and something EVORA is already leading clients through the challenges and opportunities of.

New alignments and disclosure

Recent interest in broader ranging initiatives within the real estate space have been gaining traction in the past several years. These alternative policies are likely to continue to influence the direction of how companies tackle sustainability issues, standing apart from the more prominent examples such as GRESB, LEED and a host of others.

The 2015 United Nations Sustainable Development Goals (SDGs) is one such example, acting originally as a framework for nations to engage in improving global sustainability across areas such as environment and energy, equality, health and wellbeing, alongside peace and justice. Five years since their inception, it is the real estate sector which is taking command of the targets put in place, using them to guide investment and strategy for an all-around approach to sustainability. Aligning with the SDGs is rising in popularity, and it is likely that a more open approach could inspire newer players to also play their part, committing time and resource to key targets.

Another key shift beginning to happen in 2020 focuses on the effective disclosure of climate resilience and risk to businesses through alignment with the Taskforce on Climate-related Financial Disclosure (TCFD). TCFD is a global voluntary disclosure framework launched in 2017 to allow organisations to identify climate risks and opportunities, and ultimately to disclose the financial impact of these in their annual reports. Awareness and mitigation of these risks is necessary to avoid any sudden losses in asset value and the associated impact on the wider investor market. Businesses engaging with this voluntary scheme provide greater transparency for stakeholders, but also gain an advantage when addressing wider strategies by actively moulding the methodologies behind TCFD, as well as gaining a footing ahead of competition for improving capital value. TCFD – based reporting is to become mandatory for PRI signatories from 2020.

Renewables reinvigoration

Off the back of net zero and related policies put in place by nations across the globe, renewables investment is a key piece of the puzzle to deliver ambitious targets by 2050.

It is no secret that renewables investment has been growing substantially over the previous decade, with total stock of the most widespread small-scale variant in the UK in terms of number and generating capacity (up to 5MW)– solar photovoltaic (PV) – growing from a total supply of just 88 MW in November 2010 to a staggering 13,305 MW in November 2019 according to the Department for Business, Energy & Industrial Strategy (BEIS).

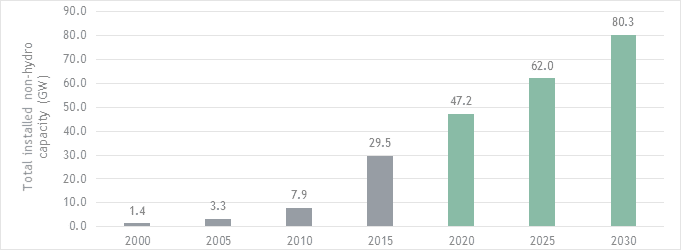

This trend is set to continue, and not just for solar, as it is speculated that across the piece the total capacity of non-hydro renewable sources is set to expand by 91% on current values, reaching 80.3 GW by 2030 [1] as shown below in Figure 1.

Policy has been a major driver of this initiative in the UK; however, it should not be forgotten that globally the price of renewables has fallen drastically, reaching the lowest point to date making it ripe for investment.

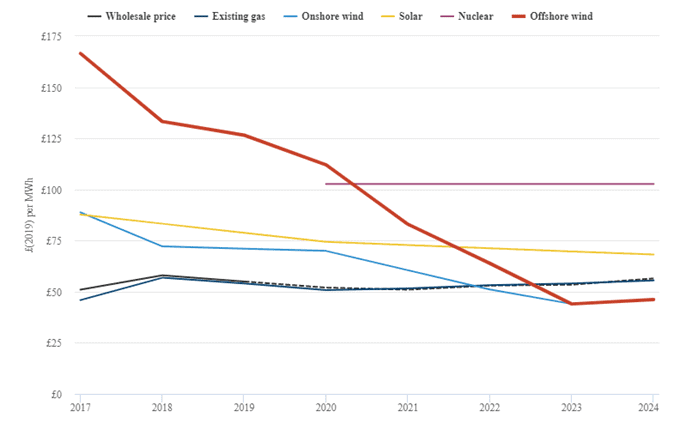

Cost reductions for solar and wind power technologies are set to continue to 2020 and beyond. Current auction and power purchase agreement (PPA) data suggests that by 2020, onshore wind and solar PV will consistently offer less expensive electricity than the least-cost fossil fuel alternative worldwide, according to IRENA [2]. And for the UK as shown in Figure 2, the current expected trajectory for wind technologies is to dip below the cost of gas, closely followed by solar which is expected to reach the same level in the late 2020s if not sooner.

With costs expected to fall, the integration of renewables will become easier and the investment more worthwhile as payoff times also decrease. This is despite the removal of the Feed-in Tariff (FiT) scheme in March 2019, however commercial contracted energy still proves to pull in promising numbers for those willing to invest in generation. Furthermore, the Smart Export Guarantee (SEG), a partial replacement for the FiT, came into force on the 1st January 2020 setting an obligation for licensed electricity suppliers to offer a tariff and make payment to small-scale low-carbon generators for electricity exported to the National Grid.

This could provide a valuable route to market for businesses wishing to put money aside for renewables, serving to cut electricity costs due to self-generation, but also providing the opportunity to export and earn money by supplying back to the grid.

Furthermore, the benefits for businesses from Corporate Power Purchase Agreements (CPPAs), specialised agreements for the supply of energy to specific sites or assets from a generator, have also grown in recent years. This differs from the standard green tariff opportunities presented by utilities, as energy is directly sourced from a known generation site which in turn spurs the delivery of greater grid investment into private energy sources as significant hurdles for generators are bypassed. Engaging in this market has proved to be a reliable means of utilising renewable energy over short term (6 month) to as long as 15-year contracts relatively inexpensively, alongside proving a positive look for companies to boot.

Who knows, perhaps this could grow into something larger? The prospect of peer-to-peer trading of energy or smart grids to efficiently serve grouped assets could also take off from greater private investment; effectively lighting the fuse for a more sustainable real estate sector, and aiding the push of ambitious policies to grow the market.

Grand designs

Changing up building management and design is also a crucial factor to consider, in order to provide more efficient, healthier and happier buildings for tenants to grow their businesses in.

One example of how legislation is progressing this scene is the recent Minimum Energy Efficient Standards (MEES) for non-domestic commercial buildings strategy, published on the 15th October 2019 by BEIS, which we reported on last year.

Under the consultation, the government propose a new plan to raise the minimum EPC rating from ‘E’ to ‘B’ by 2030. In order to achieve this, a great deal of investment will be necessary, as an estimated 85% of non-commercial buildings will require improvements to meet these standards.

Improving new build design is a clear route to achieving this across portfolios, by integrating more passive design choices, smart technologies and more controllable systems for fundamentals like HVAC systems and lighting. These include such changes as tighter building fabrics to help reduce heat loss in the building, double glazed windows as well as greater exploitation of sunlight with Passivhaus like architecture. Not only will this reduce energy usage and as a result improve the returns from markets such as the SEG for renewables, it will also result in a more comfortable space for tenants to work in, improving wellbeing from the get-go. Furthermore, buildings can also engage in improving other factors such as the integration of biodiversity into building design with green walls and roof gardens alongside open planted plazas that not only serve as refuges for wildlife but for pleasant places for employees to enjoy for increased social value.

However, this is easier said than done, as the vast majority of buildings which will be used in the commercial space have already been built. Therefore, a great deal of effort will need to be focused on deep retrofitting to bring buildings up to scratch, allowing them to stay competitive and sustainable for years to come.

Big data for bigger change

At the heart of spurring the aforementioned changes is our understanding of the ongoing trends, causes and solutions to issues at hand; and how is that really possible without proper evidence?

As the world mobilises towards an ever more data-centric model to drive cost analyses, environmental modelling and of course the progress of sustainability, appropriate levels of data access are necessary to implement effective and lasting change. Therefore, a growing need for data coverage and reporting will likely manifest throughout the 2020s, improving the understanding of where and when energy is being consumed across a portfolio to identify, implement and track improvements.

The key to engaging here is being proactive about monitoring how businesses run and how properties are managed. An example includes the continued smart meter rollout which showed promise earlier in the 2010s, however, it has fallen short of what is required as the original deadline of 2020 is pushed back to 2024. Therefore, big data companies and real estate investors may begin to invest more heavily in their own solutions to provide better coverage of how assets perform. Furthermore, by partnering more closely this could prove to be more productive than just face value cost reductions.

By engaging with tenants directly to shape their ‘energy behaviour’ from a top-down policy and technologically driven view, visible and accessible evidence of energy usage can itself inspire change from the bottom up, with tenants altering how they perceive energy usage and the impacts of their day to day. Attacking from both ends in this way may prove an effective weapon.

Big data also stretches to the social issues that real estate faces on an ongoing basis, after all, people drive business. More widespread and granular coverage of social value, health and well being among other strategies could help change the perception of how usually qualitative analyses is treated, providing quantitative means to expand the efficiency of implementing changes into businesses.

EVORA will, of course, examine the growth of these trends (as well as many more) throughout the year, as we expect a great deal of exciting activity is upcoming. So, watch this space!

Data Sources:

[1] https://www.power-technology.com/comment/uk-renewable-outlook/