Thought

GRESB 2020: Three Key Changes

Each year, GRESB works with its members and key industry stakeholders to update the assessment and address the material issues within Environmental, Social and Governance (ESG) performance of real estate investments.

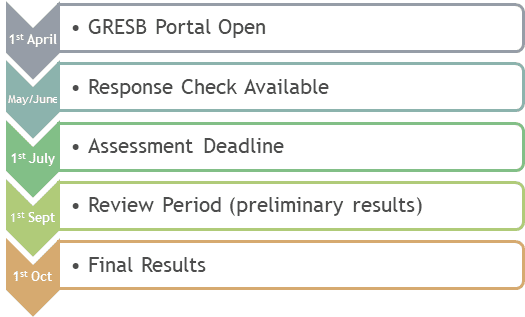

Below we outline three of the key changes following the release of the 2020 GRESB Real Estate Reference Guide ahead of the GRESB assessment portal opening on the 1st April.

1. Structure

For 2020, separate components have been introduced to the Real Estate Assessment for Management, Performance and Development. The Management and Performance components replace the Management & Policy and Implementation & Measurement components from previous GRESB iterations.

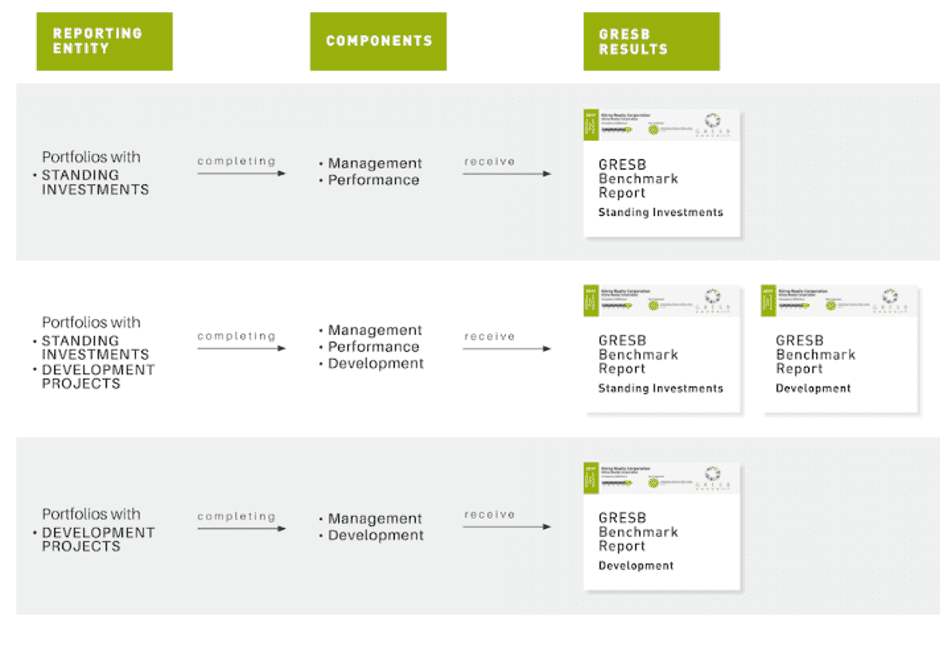

The core component of Management is required for all participants, with the type of investment (standing or development) influencing the secondary component required. Separate benchmark reports will be issued for standing investments and development investments. As shown below:

The 2020 inclusion of the Development component is a result of a merger of the previous ‘New Construction and Major Renovation’ module and the separate ‘Developer Assessment’ module. GRESB participants with development projects will now have a better understanding of their ESG performance and be able to compare with their peers.

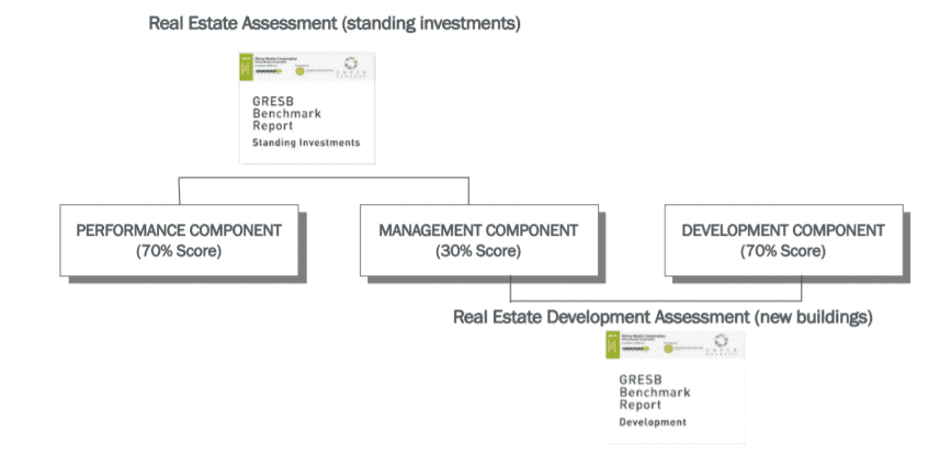

Previously, the Development Benchmark only included developers, however funds with both standing investments and development projects will be included in both the Standing Investments Benchmark and the Development Benchmark – receiving two Benchmark Reports to reflect their performance in each component. The component weighting for each category in 2020 is outlined below for standing investment and developments:

Figure 2 – GRESB Real Estate Assessment Scoring Methodology. Source: GRESB, 2020 Real Estate Indicator Summary.

2. Assessment Review Period

GRESB has also introduced a Review Period into the assessment timeline with the aim of strengthening the reliability of participant responses and the subsequent benchmark results. The review period will begin on the 1st September when all participants will receive their preliminary GRESB results for 2020. Participants will be able to submit a review request before 15th September to GRESB using the Review Form. Final results are released to participants and investor members on the 1st October.

3. Asset Focus

GRESB has continued to develop further sector definitions to enable accurate and relevant comparisons with peers. Additional property types have been introduced for 2020 which will allow in the future for more granular benchmarking of asset performance. In addition, the terminology of ‘direct’ and ‘indirectly’ managed assets has also been removed.

The timeframe for asset energy, water and waste efficiency initiatives and technical building assessments has also been reduced from four to three years. This change has highlighted the importance that GRESB places on continual improvement.

Another major change is the removal of intensities calculations, which will be a relief for many parties who have previously had to manually calculate these figures!

EVORA are perfectly positioned to provideGRESB support after supporting 73 funds to submit to GRESB in 2019, including 25 funds located outside the UK. View our official Global Partner profile.

We can work with you to complete the submission and understand your scoring, as well as develop a sustainability plan that will improve your future GRESB performance and align with your organisation’s key environmental objectives.

Contact usto see how we can help you.