Thought

How can ESG help deliver better infrastructure?

Infrastructure is vital for living comfortable, convenient modern lives. Every day, infrastructure systems are working beneath the ground, on the land, and above our heads. Each morning, when you turn on the tap, power up your computer, or step outside to travel to work, you are interacting with infrastructure. Infrastructure has a life of its own and without it our modern lives would be very different.

Infrastructure is a huge area of investment globally which attracts both government and private sector funding. Due to its size and complexity, it often requires a complex mix of investment strategies including debt, equity and bonds. Infrastructure assets, alongside real estate, are categorised as real asset investments and therefore they share similar Environmental, Social and Governance (ESG) risks and opportunities. However, the scale and complexity of infrastructure assets can create some unique challenges.

The United Nations predicts that population growth will continue, reaching 9.7billion people on the planet by 2050. Much of this population growth will be in urban areas, and infrastructure provisions will need to grow alongside the population. As a result of the continued and growing demand for infrastructure provisions, infrastructure assets have significant potential to positively affect the environment and society. These assets will also play a role in creating a successful and resilient response to the challenges of a changing climate, as well as being affected by climate change themselves.

Due to the pivotal role infrastructure assets hold in meeting current and future demand, and their centrality in addressing climate change, they have varied and wide ranging stakeholder interest groups with high levels of expectation when it comes to ESG delivery. For this reason, EVORA are seeing many investors coalesce and gravitate toward the United Nations Sustainable Development Goals (UN SDGs) as a suitable framework that addresses stakeholders concerns and which they know and understand. Increasingly, there is a growing expectation that implementing effective ESG strategies aligned to the UN SDG’S which address the associated risks and opportunities and link actions to outcomes is becoming the minimum requirement.

This year, the Covid-19 pandemic has profoundly impacted the global economy, causing many to take stock, reflect and consider the future of society. We face dual crises: responding to the pandemic and addressing and responding to environmental and social challenges, including climate change. In a post-Covid world, infrastructure can be central to addressing these multiple challenges. This has been solidified by both the UK Government and the new US administration pledging to place investment in infrastructure at the heart of their ‘build back better’ programs.

So why look at infrastructure now? Firstly, investment in infrastructure development is urgently needed to replace aging and poorly performing assets with assets fit for the 21st century that positively address the climate crisis. Secondly, infrastructure assets are fundamentally about investing in future generations but also, crucially, provide much needed jobs today, thereby providing an excellent way to rebuild and diversify regional and national economies. With these factors in mind, having robust ESG management becomes essential in managing outcomes as well as demonstrating effective use of funding vehicles.

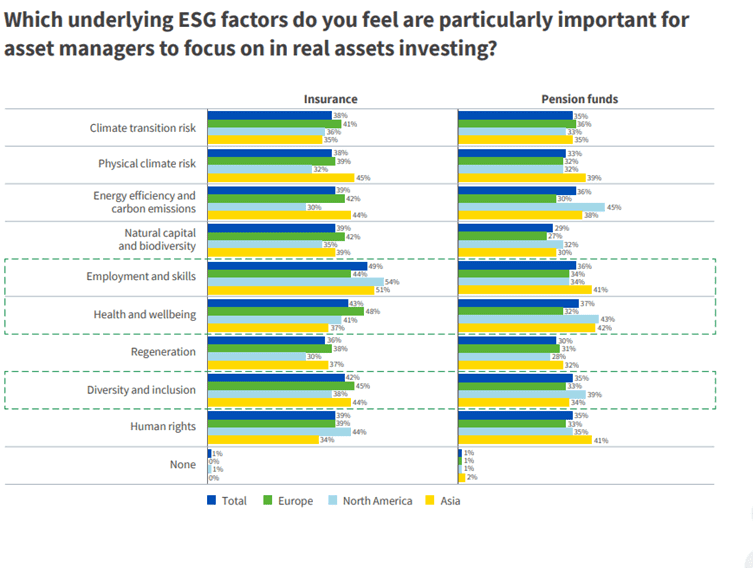

In the recent Aviva Real Assets Study 2020 [1], in which global institutions were asked about their views on ESG post-COVID, the overwhelming response showed ESG as front and centre for investors’ concerns. 81% of respondents stated that ESG objectives and delivering on sustainability is a primary duty of their organisations. Furthermore, 91% of global insurance and pension fund investors are now committed to delivering Net Zero. As a result, infrastructure assets in all its various classes and forms are the foundation for how the Net Zero commitment will be realised. The Aviva survey also indicates that ESG has evolved in its sophistication and needs to be considered as a balanced a score card between the ‘E’ and ‘S’ and not simply about environmental risk management that has been the focus in the past.

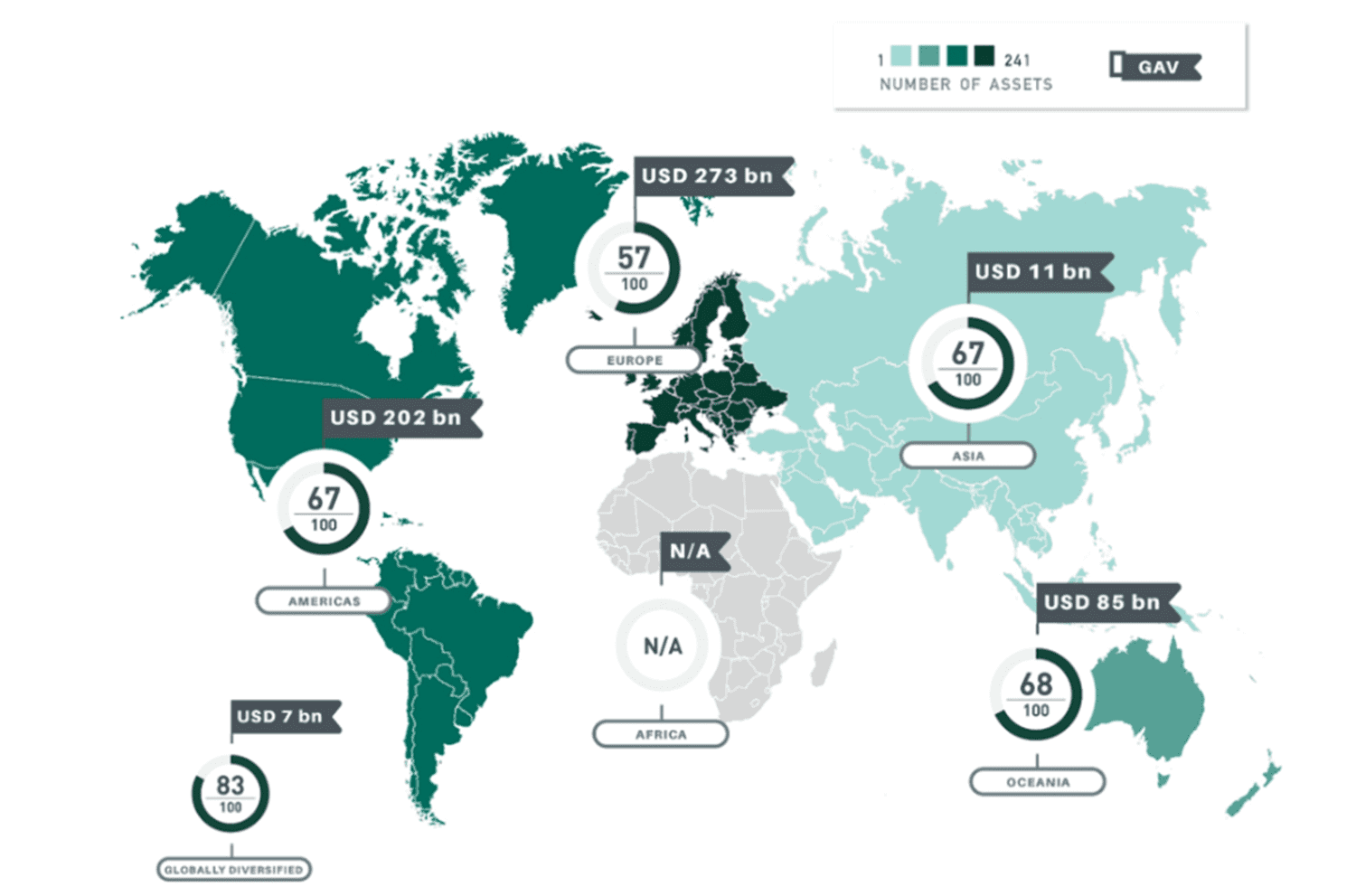

So how can the ESG and sustainability agenda be delivered in practice? There are a variety of excellent reporting frameworks, such as GRESB and the UN Principles for Responsible Investment (PRI), for investors to work within which provide globally recognised frameworks which set a baseline for benchmarking performance. Launched in 2016, GRESB Infrastructure continues to grow in popularity, with over 426 assets totalling $579billion assets under management participating in 2020. As the scheme evolves, greater focus is given to performance outcomes rather than just good intentions. Now more than ever, it is imperative for investors to analyse, understand and seek ways to optimise ESG performance in their investments. Reporting is a great place to start.

We have been working with closely with investors over the past decade to deliver best-in-class ESG practices, helping them strive to constantly do better by setting ever more ambitious targets to improve ESG performance. EVORA can help you understand and optimise your infrastructure ESG approach. If you are interested in finding out more, contact the team at infrastructure@evoraglobal.republiken.se.