Thought

A Summary Guide to The CRREM and SBTi Update

The Carbon Risk Real Estate Monitor (CRREM) & Science Based Target initiatives (SBTi) have recently published updates to the decarbonisation pathways. The recently released version is 1.5⁰C aligned and affects the tool’s underlying data in three important areas: carbon intensity, energy intensity, and SBTi-alignment. The new version addresses updated global emission budgets as well as CRREM-SBTi aligned decarbonization pathways at property level. CRREM- SBTi pathways cover the residential and commercial real estate sector across North America, Asia-Pacific, and Europe. To help understand how the pathways have been updated and the potential impact, EVORA’s Net Zero Carbon team has developed a CRREM Update Summary Guide. The following guide focuses on where the changes are most significant, what high level information is relevant and what is the impact of the changes.

Introduction

In January 2022, SBTi and CRREM announced that they would join forces to provide fully aligned 1.5°C decarbonization pathways for the real estate sector. This partnership combines previous work by both organizations and creates a global standard for operational decarbonization of buildings, providing companies in this sector with the clarity and confidence that their decarbonization plans are aligned with climate science.

The pathways are now called “CRREM SBTi pathways” for existing buildings. CRREM-SBTi pathways cover residential and commercial real estate sectors across North America, Asia-Pacific, and Europe.

Key Updates Summary

Decarbonisation Pathways

- The baseline year of the CRREM operational decarbonization pathways was updated from 2018 to 2020.

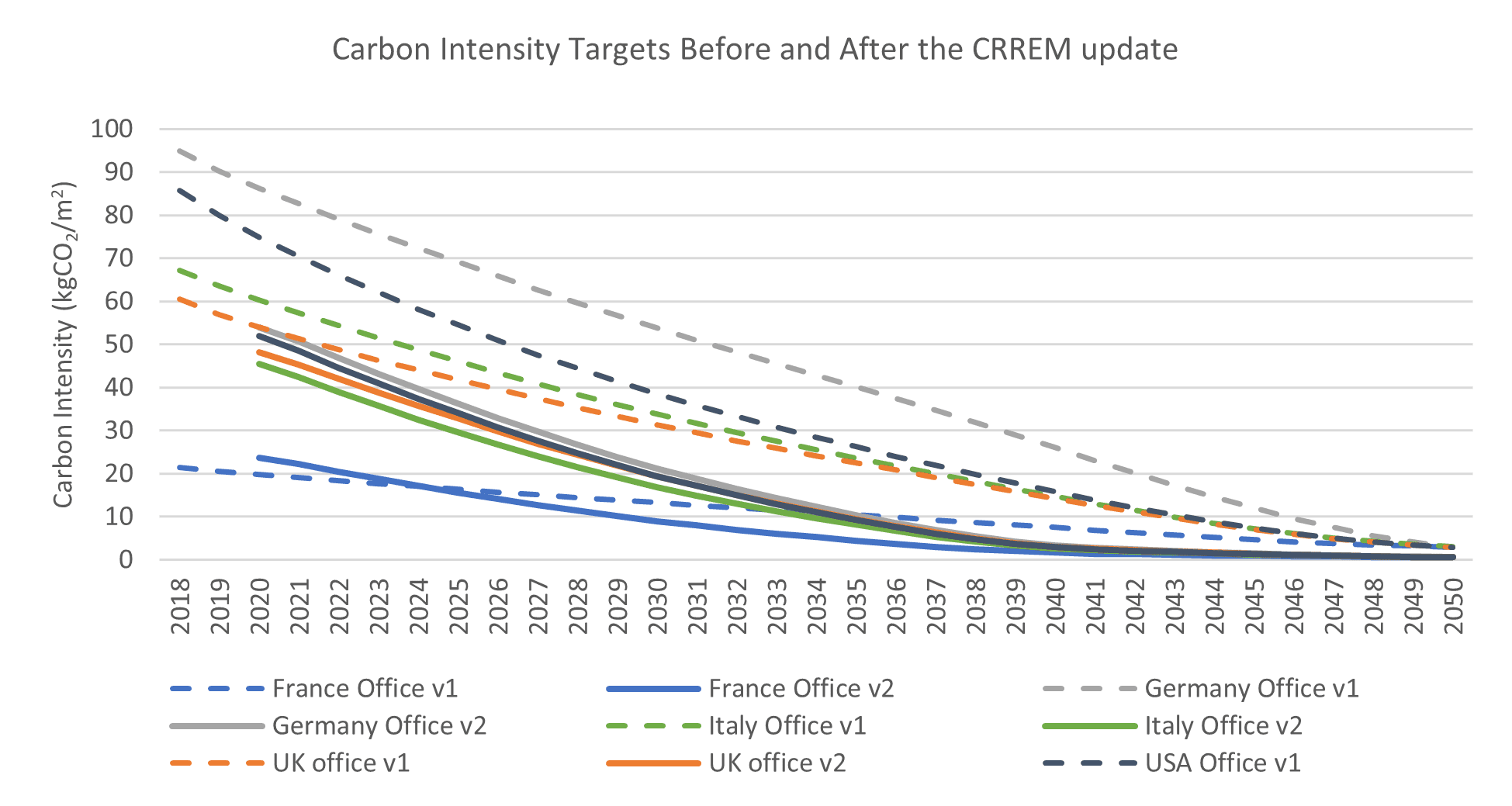

- Due to exceedance of existing carbon budgets between CRREM v1 and v2, the baseline for most v2 pathways is lower than previous version (for e.g. German office target v1 value for 2020 was 86 kgCO2/m2 and v2 value is 54 kgCO2/m2). There are a few countries (mainly non-EU) with higher 2020 baselines, but all these pathways continue to show a steeper reduction in the pathways.

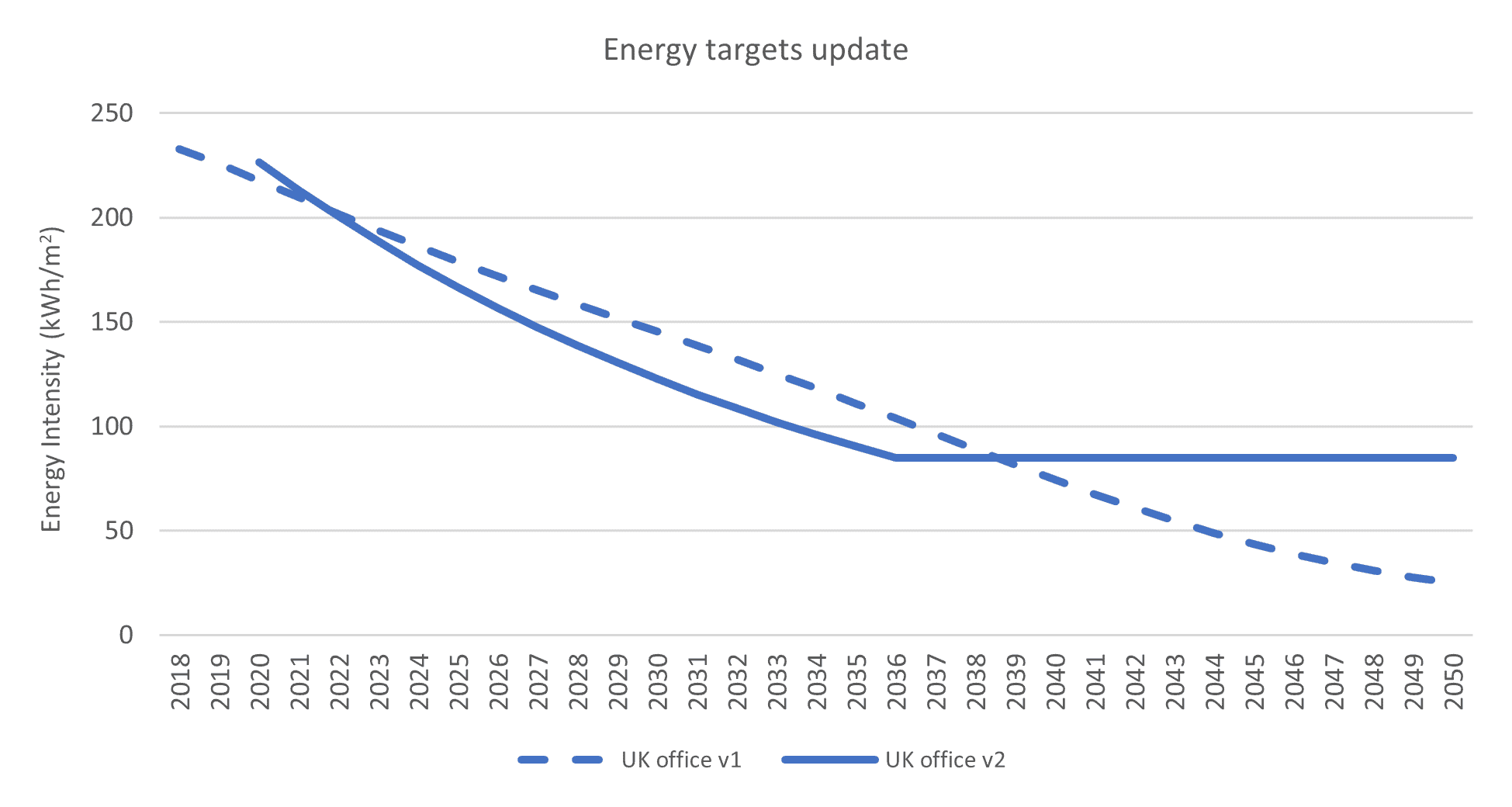

Energy targets now plateau after 2035 once a predetermined percentage reduction from the 2020 starting point is achieved (ref. figure on the right), rather than continuing to decrease as in the previous version, since most energy sources will be fully decarbonized in 2050 the allocation of available renewable energy will define the limitation of energy use per sqm.

Methodology and new functionality

- The CRREM Energy Use Intensity (EUI) pathways now refer to a building’s energy consumption (gross), which includes all direct combustion, electricity consumed from the grid, district heat purchased, as well as renewable energy produced and consumed on-site (also known as ‘site-energy’), rather than the net energy demand from v2, which excluded energy produced on site. The gross energy consumption of a building approach is to promote efficiency-first strategies. Note that energy generated and consumed on site is still reducing CO2 intensity of an asset as the on-site renewable energy has an emissions factor of zero.

- To differentiate between carbon (CO₂ /m2) and Greenhouse Gas (GHG) (CO₂e/m2) targets, a new pathway has been added that incorporates fluorinated gases emissions (F-gases) – human made gases used in industrial activity.

- A new pathway for “Industrial Distribution Warehouse Cooled” has been published to account for increased electricity consumption from refrigeration and space cooling.

- New sub-regional pathways covering the 15 largest cities in the United States and the six climate zones in Australia have been published.

Drivers and Considerations Behind the Changes

- The remaining global anthropogenic budget slightly reduced: On a global scale, we do not see significant changes regarding the remaining carbon budget compared to CRREM’s first version (468 vs. 519 GtCO₂ – only). This 10% decrease regarding the remaining budget from 2020 onwards until 2050 causes the decarbonization curves to be steeper (stricter) as seen in the image below. Leaving all other aspects unchanged this will of course imply lower intensities per m² floorspace in the future.

- Sector overshoot: At this time, almost every sector in the world is performing below the level required for achieving the 1.5c pathway. The result is updated budgets with more severe pathways and earlier stranding risk dates than those predicted by the previous model. The pathways have become stricter (steeper) because the real estate sector has shown more consumption than projected from the baseline year (since 2018). The overall remaining budget from 2020 onwards is reduced due to this aspect, and energy/carbon intensities are currently on average higher than projected based on the first CRREM pathway release.

- Building stock growth rate with largely unchanged projection: Global floorspace projections did not change significantly. New figures show an overall increase of 1.6% compared to the previous data from 2020 to 2050. This implies a slightly lower intensity per m² floorspace.

- More ambitious grid decarbonization: The decarbonization of the electric grid has gained momentum in recent years and emission factors (EF) for electricity have decreased dramatically. This, in turn, reduces carbon intensities for the same energy consumption level. At the same time this implies lower intensities per m² floorspace since future projections for the energy sector show on average more ambitious grid decarbonization until 2050.

- Changing energy-mix / electrification: Besides a move towards more renewables, we note that generally the electrification of the real estate sector is also gaining momentum. In countries with a lower emission factor for electricity compared to the remaining energy mix, this is decreasing the weighted EF already today. In some countries, a current relatively higher EF of the electric grid compared to the remaining energy mix is leading to increased carbon intensities of the sector. Regarding projections, we note that electrification combined with the decarbonization of an electric grid plays a major (indirect) role for the real estate sector to achieve climate targets.

- Alterations of the applied methodology: Due to the alignment with the SBTi, CRREM has now applied the EF (for electricity) excluding transmission & distribution losses. In the first version of the CRREM pathways, the EF were including T&D-losses. The lower EFs are now reducing carbon intensities accordingly (within pathways but also when using the tool with updated and lower EF).

CRREM Pathways and The Impact of Changes

CRREM pathways have already influenced how decisions around decarbonisation are taken. As climate action accelerates and investors and asset owners begin to implement net zero strategies the revisions to targets will require a re-evaluation of previous findings and modifications of strategic approaches to assets in portfolios and potential acquisitions. The potential major impacts include:

- Carbon and energy intensity targets have become stringent in many countries including USA, France, and Germany. Significant change is seen for France, where a steep trajectory down to the 2036 energy target is seen as compared to previous target.

- The changes to the baseline for most pathways emphasise the need for short term carbon reductions to reduce the risk of asset stranding. This emphasis will require more immediate financial mobilisation may prove challenging in an uncertain economic environment.

- Energy efficiency and demand reduction would be the most critical action to be taken in the short term for countries (e.g., the United States) where grid decarbonisation has declined while carbon and GHG reduction targets have become more rigorous.

- Due to the fact that now – in contrast to the first CRREM version – some energy sources are actually completely decarbonized by 2050 according to forecasts, the existing method of deriving the energy paths was expanded. For this purpose, the concept of energy target values was introduced. With these target values, it should be noted that target achievement is only achieved if

- The EUI corresponds to the stated energy-intensity figure, AND

- The asset also meets the CO2-target for the respective year (which means in 2050 it must be completely decarbonized, renewable energy).

- It is important to note that the baseline year of the operational (‘in use’) decarbonization pathways for CRREM has been changed from 2018 to 2020. This is because the real estate sector has demonstrated higher overall consumption since 2018 than what was anticipated in CRREM V1.

What next for CRE?

- As the results of CRREM have influenced many CRE companies’ investment plans, the revisions to the targets will require you to re-evaluate your previous findings and modify your strategic approaches to assets in your portfolios and potential acquisitions.

- Energy efficiency measures must be implemented quickly over the course of next eight years, and the impact (energy demand reduction) from the measures must be tracked and analysed on a regular basis.

- Decarbonisation programmes that fail to meet their goals do so because they are not properly programmed and planned for. Net zero needs to move from strategy to implementation quickly – retrofitting high-emissions assets, making procurement decisions and proactive tenant engagement.

- The emphasis on short term carbon reductions to reduce the risk of asset stranding will require more immediate financial mobilisation.

- The consumption based EUI view stipulates that energy consumption reduction through efficiency strategies rather than addressing the entire energy demand with renewables produced on-site, as in the previous version, should be tackled first. Energy efficient buildings are therefore not just net-energy-efficient but rather low-energy-consumption properties – which in turn can contribute to an overall cleaner grid by producing more renewable energy on-site than they need to cover their own demand.

- For assets with late lease expiration dates and RFI assets, tenant engagement is more important than ever.

The full new CRREM tool for EU is expected to be published later this month. Look out for further updates from EVORA.

EVORA can support clients by reassessing and adjusting their strategic approaches to existing assets in their portfolios and future acquisitions.

Get in touch with our expert Net Zero Carbon team to find out how they can help you.