Thought

Building Back Better the Potential of Infrastructure

By Matthew Brundle and Natalie Sinha.

Can Infrastructure Shape a New Sustainable Future and what should investors know?

As global populations increase, the UN estimates that there will be 9.8 billion people on the planet by 2050. Estimates predict that 68% of the global population will be in urban areas by this time. [1]With an increasingly urbanised global population, the number of megacities is also expected to increase rapidly to 43 Megacities by 2030, with more than 10 million inhabitants in each. There is evidently a pressing challenge to ensure that infrastructure embeds sustainability into cities by encouraging low emissions lifestyles and promoting equitable living. With the passing of 2020 under the cloud of the global pandemic of COVID-19, we are moving into a new decade. This decade has been billed as ‘the decade of action’ on sustainability. What role should infrastructure play in meeting the challenges of sustainability and climate change whilst rebuilding economies?

Firstly, we need to consider the existing environmental, social and economic impacts from infrastructure to understand how it can be used in building a more sustainable world. Not all infrastructure is equal today or will be in the future in terms of environmental impact and as a force for positive social change. Traditionally, public and private sector investors have viewed infrastructure as a safe, long term and stable investment class, which makes infrastructure investments ideal for pension fund investors and Government bonds. However, the picture is complex and nuanced: there are signs investors are seeking to acquire specific types of infrastructure classes, whilst moving away from others. Furthermore, the COVID-19 pandemic has exposed the vulnerability of some infrastructure assets in a changing world, a prime example being that of transport infrastructure.

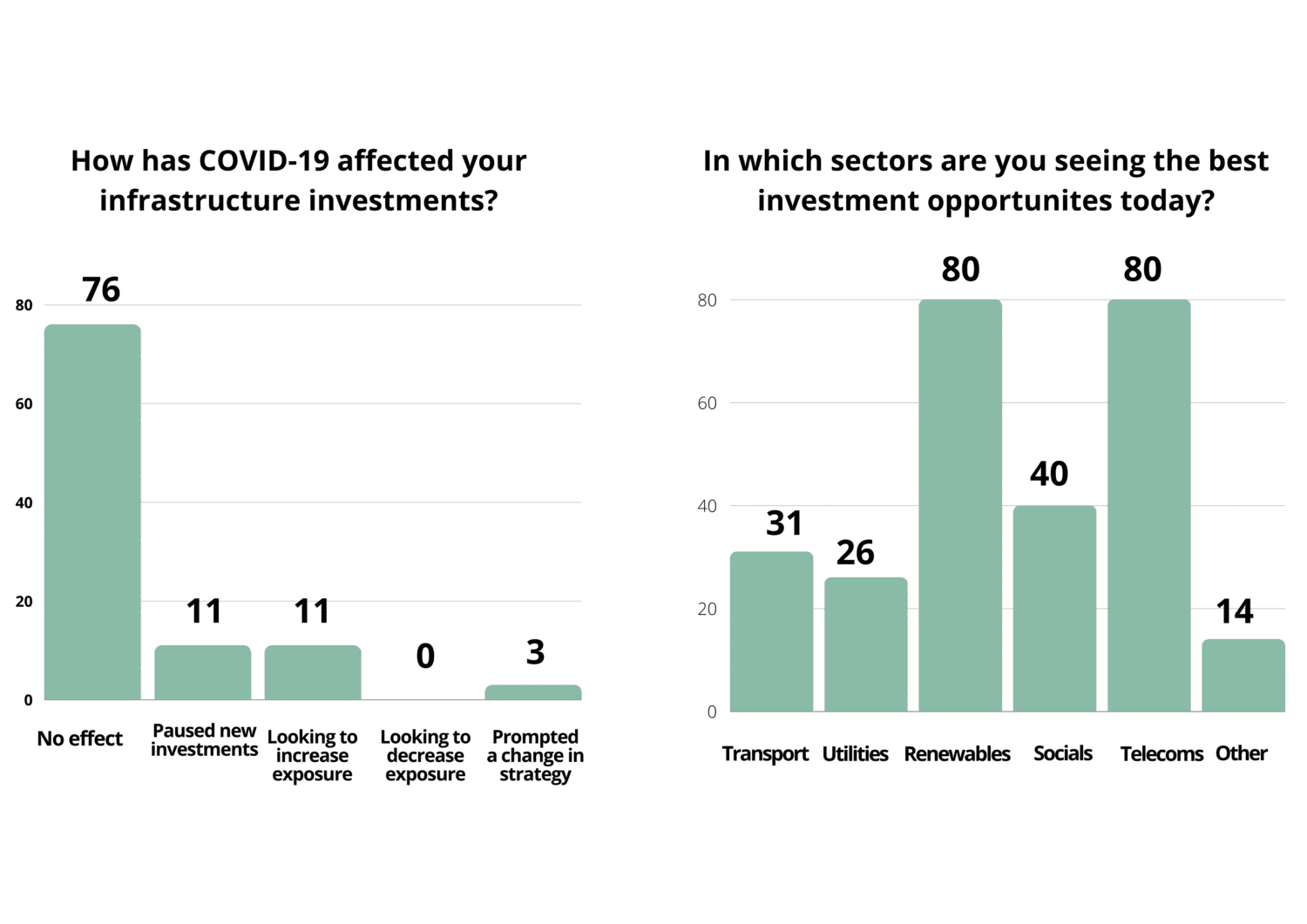

In the recent annual investor survey by IPE Real Assets two questions revealed this changing attitude [2], demonstrating that infrastructure remains an attractive investment class overall, but renewable energy and telecommunications/digital infrastructure are providing the most interest from investors compared to other types of investments.

Infrastructure in a changing world

The COVID-19 pandemic has also highlighted the need to re-think what the future of infrastructure might look like, taking into account future patterns of work, recreation, and travel. Whilst it is apparent that people will want to travel again once restrictions have been lifted, the way we travel in the future is still a point of speculation: the mode of transport, frequency of travel and destinations are likely to be reshaped. These factors will profoundly impact future infrastructure considerations determining city growth and regeneration plans.

It is self-evident now that our reliance on telecommunications and digital infrastructure has never been greater, for keeping in contact with friends and family, working from home, and shopping online. In our reshaped world, digital communications will continue to become an even more essential part of keeping global markets open. They also provide an opportunity to do business more efficiently and with a lower carbon impact by avoiding unnecessary global travel. A key challenge for this asset however it to ensure that society as a whole has equal access to the new digital word.

The recent speeches by UK Prime Minister Boris Johnson and US President Joe Biden highlight the pivotal role digital technologies play in re-invigorating society and unlocking regenerative growth from struggling old industrial cities with the new digital technologies of the future.

The most pressing challenge of our time however is the transformation of energy infrastructure: moving from existing fossil fuel intensive sources to low and zero emissions energy. There is no doubt there is a need for continued but more rapid energy transformation both in terms of technology adaption and grid decentralisation. The current challenge for major power generation plants is centred on a delicate balancing act, requiring careful downscaling of existing fossil fuel intensive assets, whilst continuing to manage them well. This will potentially enable some fossil fuel assets to minimise emissions today and potentially be converted to run on lower emissions fuels in the near future, such as switching from natural gas fired power stations to lower emissions gases like hydrogen.

There are also challenges in how the energy sector dovetails with the built environment and real estate sector. For example, enabling the increased use of renewable energy sources, incorporating energy storage into the grid, as well as integrating power management systems to increase energy network resilience. The energy infrastructure system therefore needs to undergo significant change as it plays a key role in supporting the delivery of net zero carbon for real estate.

Governments committing to building back better

It is both encouraging and timely that the new US Biden administration and the UK Government have been raising the profile of infrastructure during recent speeches and have committed to “build back better”. They have stated the intention to invest in infrastructure to provide multiple benefits: tackle the climate crisis; redress social inequities highlighted by the pandemic; and use infrastructure investing as part of their ‘levelling up’ agendas.

In addition, Alok Sharma MP, the President of the UN Climate Change Conference of the Parties, which is scheduled for November 2021 in Glasgow, has also referred to the need for infrastructure to be central to building back better. In fact, the theme is becoming so central to the UK Government policy for 2021 and beyond it has established a dedicated Build Back Better Business Council with the inaugural meeting being held on 18th January 2021. [3]

The Prime Minister outlined the need to seize opportunities of Brexit, support job creation, cement the UK’s position as a science superpower, deliver an upgrade to infrastructure and launch a green industrial revolution – ensuring that we build back better, fairer, greener, and faster.

The Chancellor laid out the three key pillars of the government’s plan to drive growth beyond the pandemic: investing in infrastructure, skills and innovation. He set out that improved infrastructure leads to improved productivity, [and] skills are the single best way to drive human productivity and key in addressing regional disparity, and investment in innovation is critical to deliver new growth, ideas and services.

So why is investing in infrastructure the right thing to do at a time when the global economy seems on its knees? The truth is Governments around the world have always favoured investing in infrastructure as a fundamental element of growing an economy. Not only does it demonstrably invest in your own nation and its future generations, but it also stimulates economic inward investment throughout the economy, enabling it to grow or regrow from within. A 2009 report entitled ‘Construction in the UK Economy: The Benefits of Investment’ showed that every £1 spent on UK construction led to GDP growth of £2.84 [4]. The report also showed that, of the money invested in the construction sector, over 70% remained in the local and national economies. This is due to stimulation elsewhere in the construction value chain, benefits of employment opportunities and wider social and economic benefits such as better education services delivering a higher-skilled workforce.

More recently, a 2018 report by CECA entitled ‘The social benefits of infrastructure investment’ [5] illustrated the social value of investing in infrastructure. The report uses case studies to show how infrastructure shapes our everyday lives in many ways we take for granted, ranging from how we work, travel, spend leisure time, respond to climate change and tackle poor quality in urban environments. It also reminds us that past major public health crises have sparked ground-breaking innovation in infrastructure: after four major cholera outbreaks in London between 1832 and 1866, Joseph Bazalgette revolutionised the sewer network for central London which was instrumental in relieving the city from cholera epidemics, while beginning to clean the polluted River Thames. The pandemic crisis of 2020 has the potential to spark similar transformational changes in our infrastructure networks and systems.

The future of infrastructure?

We have sought to highlight some of the key global patterns in infrastructure investing, as well as governmental commitment to ‘building back better’. It is clear that the landscape of infrastructure is continually evolving and can play a central role in economic rebuilding and growth.

Humankind is unquestionably at crossroads in how we shape our society and the future. EVORA firmly believes that through drive, creativity, and passion there is much to be gained from tackling the challenges set out in this article. Whilst some investors may see the challenges discussed in this paper as a significant risk to your investments, we urge you to also consider them as significant opportunities and to do more for your investors and for the next generation by embracing sustainability and ESG and using this to drive forward innovation.

On a final point and note and inspiration, in a recent article published in IPE in January 2021, it is noteworthy that the United Nations Principles for Responsible Investment (UN PRI) and some significant pension fund investors have called for dialogue with the UK Government on practical ways to access the ‘unrealised reservoir of support from the investor community for stronger climate action’ [6] and to help the delver UK’s 10 Point Plan for a Green Revolution [7]. Although the discussions have not been undertaken at this stage, it is evident there is a strong appetite for ESG financing for the benefits of investors and society. What a great way to start a new decade.

If you would like to discuss improving the sustainability of your infrastructure assets or funds, please contact us at infrastructure@evoraglobal.republiken.se

Sources:

- https://www.un.org/development/desa/en/news/population/2018-revision-of-world-urbanization-prospects.html#:~:text=News-,68%25%20of%20the%20world%20population%20projected%20to%20live%20in,areas%20by%202050%2C%20says%20UN&text=Today%2C%2055%25%20of%20the%20world’s,increase%20to%2068%25%20by%202050.

- https://realassets.ipe.com/top-100-infra-investors/top-100-infrastructure-investors-2020/10047937.article?utm_campaign=236427_Copy%20of%20IPE%20Real%20Assets%E2%80%99%20rankings%20of%20the%20world%E2%80%99s%20largest%20real%20assets%20investors%20and%20investment%20managers&utm_medium=email&utm_source=IPE&dm_i=5KVE,52FF,128KV5,LHCK,1

- https://www.gov.uk/government/news/first-meeting-of-the-new-build-back-better-business-council

- https://www.lek.com/press/construction-investment-provides-significant-benefit-uk-economy-reveals-new-report

- https://www.ceca.co.uk/app/uploads/2018/12/Cebr-CECA-report-The-Social-Benefits-of-Infrastructure-Investment-FINAL-December-2018-compressed-2.pdf

- https://www.ipe.com/news/major-uk-pension-funds-ask-prime-minister-for-net-zero-meeting/10050209.article?utm_campaign=255116_late%20edition%2025.1.21%20ipe%20daily%20news&utm_medium=email&utm_source=IPE&dm_i=5KVE,5GUK,128KV5,MYUW,1&adredir=1

- https://www.gov.uk/government/news/pm-outlines-his-ten-point-plan-for-a-green-industrial-revolution-for-250000-jobs