Thought

The UK’s Grid Electrification – What’s Changing?

Series: The UK’s Grid Electrification | Part 1/3

The UK’s energy system is in the middle of its biggest transformation in decades. The government’s Clean Power 2030 Action Plan lays out an ambitious goal: 100% clean electricity. But here’s the problem – the grid wasn’t built for this shift, and real asset investors are caught in the middle of it.

The UK’s Plan for Clean Power

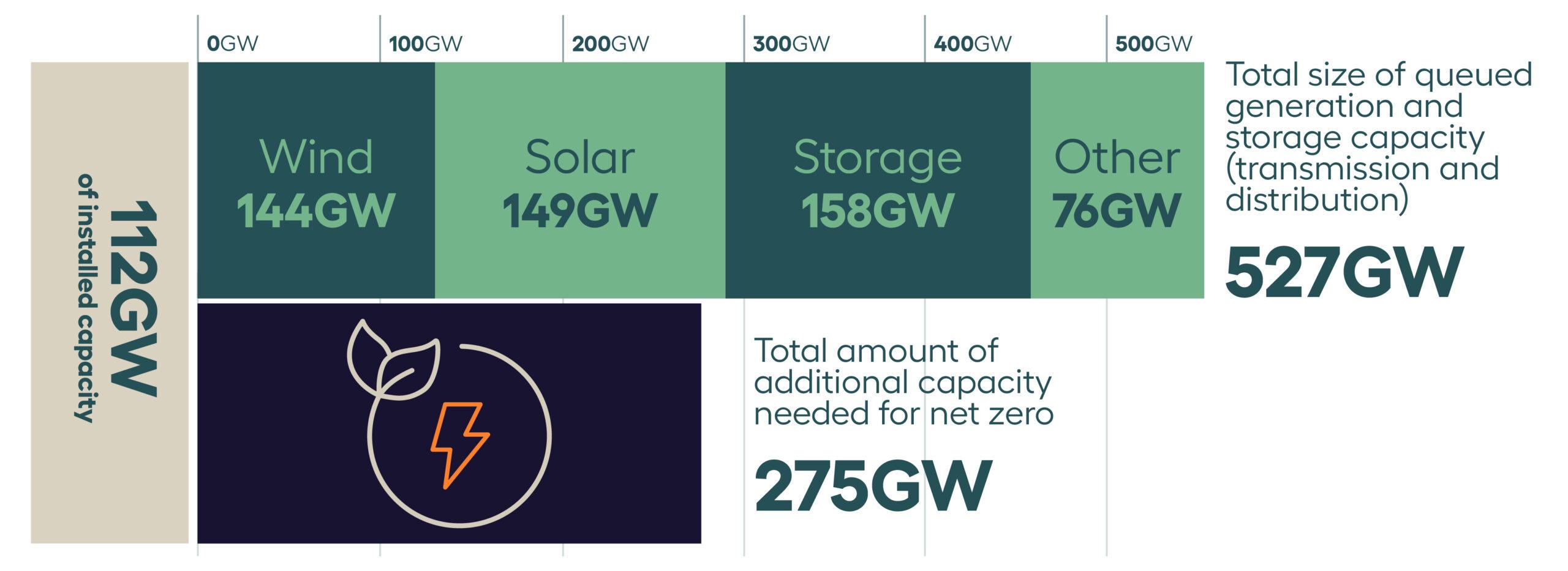

Renewable generation is surging, but the infrastructure to connect and distribute it is a bottleneck. Right now, developers are sitting on a backlog of energy projects that could take years to connect. The power-generation sector believes that there are more than enough ways to generate the renewable power needed – the backlog in applications to connect them to the grid is cited as evidence for this. However, some have challenged this, arguing too many projects in the backlog are not ready-to-go. And that has massive implications for real estate investors juggling long-term Net Zero pledges, asset values, and risk mitigation.

“Over the last 10 years, the UK has seen a massive 261% increase in renewable energy generation, both at the building level and nationally. Offshore wind farms have expanded, and there’s been a surge in applications for solar farms on land. We haven’t been standing still, but achieving a fully clean energy grid will take much more work.”, says Matt Browne, Associate Director at EVORA.

The energy generation landscape has changed dramatically in the UK in recent years. Between 2013 and 2023, there has been an increase in grid energy from renewable sources by 261%. The challenge for National Energy System Operator (NESO – previously National Grid) and regional District Network Operators (DNOs) is not creating enough power from renewables – it’s connecting and distributing it where it’s needed.

The UK government is tackling three core challenges:

1. Grid capacity constraints – Planning reforms and infrastructure investments aim to ease the backlog, but it’s not a quick fix. Some areas are already at a breaking point.

2. Energy flexibility – Time-of-use pricing and demand-response incentives will reward businesses that can shift energy use to off-peak hours.

3. Storage solutions – Hydrogen-to-power facilities and long-duration electricity storage will help stabilise supply during intermittent renewable generation.

This is all tied to Net Zero, both at the national level and for investors. Over 80% of the UK’s largest property investors have some form of Net Zero commitment for 2030 or 2050. But if energy supply can’t keep up, the path to decarbonisation gets steeper. Investors who fail to adapt to these shifts risk sitting on stranded assets.

Following the launch of the Clean Power 2030 Action Plan, a flurry of further announcements has been made to give the industry clarity on how some of these challenges are being addressed. In February 2025, Ofgem announced changes to how new power will be connected – prioritising ready-to-go generation which will contribute to clean power. But challenges still remain around distribution of power to where it’s needed.

Energy Costs: Who Wins and Who Loses?

Energy pricing is moving away from fixed costs and towards real-time market dynamics. The biggest winners will be those who can play the system – using storage to buy electricity when it’s cheap and sell it when demand spikes. Buildings that can’t adapt will be stuck paying a premium, and for investors with carbon reduction targets, this introduces new financial and reputational risks. If power shortages or high costs slow down a building’s transition away from fossil fuels, meeting Net Zero commitments becomes harder. That, in turn, affects ESG reporting, access to green financing, and tenant demand – because occupiers and investors are increasingly scrutinising whether assets are actually decarbonising or just making promises.

Take January 2024, for example. A cold snap, zero wind, and high gas demand sent electricity prices through the roof. Investors who had storage in place could have made money selling back to the grid. Those who didn’t? They just watched their costs explode.

Expect more of these volatile moments – and prepare for investor scrutiny on energy risk management.

How Will This Change the Market for Consumers?

Energy tariffs are shifting. Traditional pricing based on consumption alone is being replaced with composite tariffs that factor in time-of-use. Using power during peak demand will cost more, while off-peak consumption will be cheaper.

Flexibility will be rewarded. Consumers who can adjust their energy use stand to benefit. Demand Side Response mechanisms—where users get paid to reduce or shift consumption—are expected to expand beyond large industrial users.

Procurement is evolving. More businesses will look to Power Purchase Agreements (PPAs) to lock in stable pricing, particularly high-energy users who need infrastructure that gives them more price control whilst still allowing some flexibility in procurement.

Costs are a growing concern. Switching from gas to electricity will increase operational costs at today’s rates, hitting those making the transition hardest. There’s ongoing lobbying to break the link between electricity and wholesale gas prices, but no policy changes have been announced yet.

3 Steps to Future-Proofing Your Assets

1. Map your assets’ grid risk. West London, the Scotland-England border, and parts of the Southwest are already struggling with capacity constraints. If your building is in one of these areas, securing additional power won’t be cheap or quick.

2. Think beyond consumption. If you’re still treating energy as just another line item on your budget, you’re missing out. Investors who generate and store power on-site can protect themselves from rising costs, keep Net Zero targets on track, and even create new revenue streams.

3. Follow the money. Time-of-use pricing and demand-response programs are growing. These aren’t just compliance mechanisms – they’re financial opportunities that could help de-risk portfolios over time.

The energy transition is fundamentally reshaping how buildings are powered, valued, and managed. Investors who move first will be ahead of the curve – those who wait will be scrambling to catch up.

Will your assets be affected by the UK’s grid electrification? Read the next article in the series for more insights on the topic.