Thought

Software as the foundation for investment grade data (IGD)

ESG is here to stay. Momentum is gaining to improve data quality and consistency. Regulations such as Sustainable Finance Disclosure Regulation (SFDR) are clearly helping to drive this. The perceived distinction between financial and non-financial data is not helpful one when ESG data, which might conventionally be seen as non-financial, is used all the time to inform investment decisions.

Clearly those who are managing data for ESG strategy implementation and reporting rightly need to focus on aspects, which London Stock Exchange highlighted, such as:

- Reporting boundaries: ensuring data aligns to the fiscal timeframes and financial structure

- Comparability and consistency: employing best practice in terms of methodologies

- Provision of data: qualitative and quantitative for vital context and narrative.

- External assurance: adding credibility to ESG reporting by following the principles of an independent auditing of the process.

- Accuracy: establishing robust systems to bolster the collection and quality of ESG data.

Historically there’s been underinvestment in the systems and processes in the real estate sector to address data accuracy and quality. This can be said in relation to the adoption of technology but also from a resources and experience perspective. The requirements and expectations of ESG reporting in real estate has evolved rapidly and perhaps faster than the pace many companies are going at to address these gaps. Key to success in this is engaging those involved in the foundations of ESG data and with the tools like SIERA and SIERA+.

Take for example Net Zero Carbon (NZC) as a relevant ESG theme. Many real estate companies have made public commitments to reaching NZC by 2050. NZC is now firmly on the radar of Asset and Investment managers who are getting their heads around a new lexicon and learning how they begin to develop asset business plans and investment strategies that mitigate these transition risks.

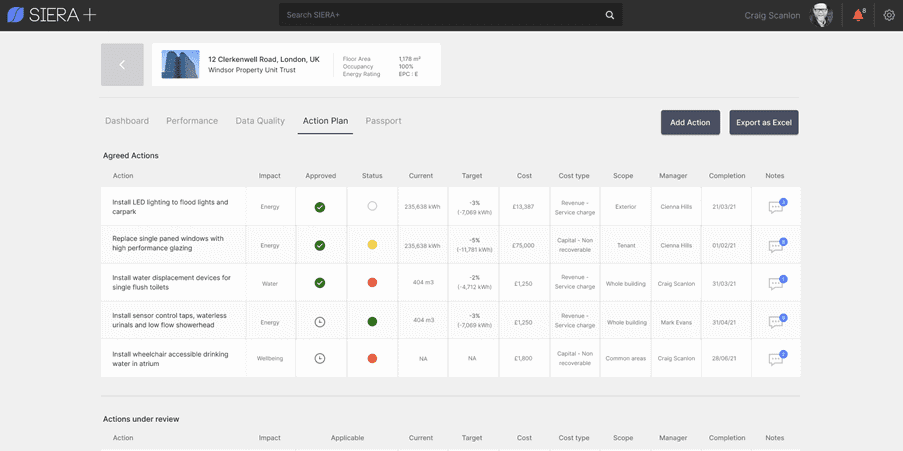

A necessary first step is to get a baseline of performance to understand the current energy and carbon intensity of assets and funds/portfolios and what the impact of current action plans will be on NZC pathways.

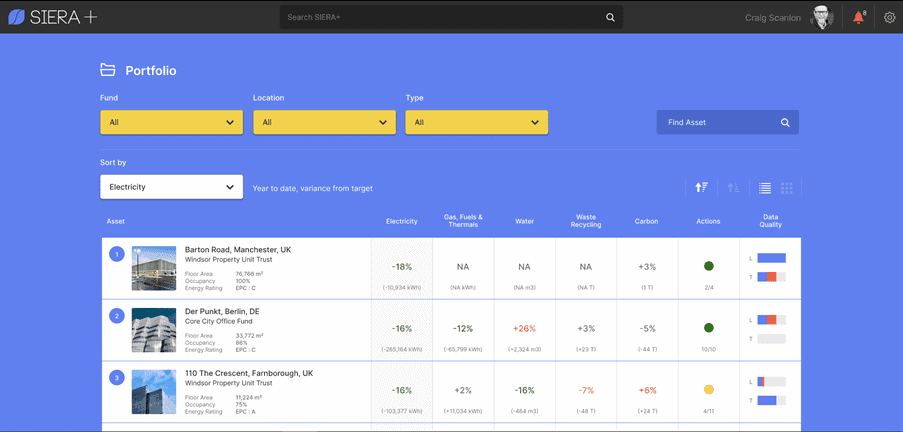

To achieve this companies must get the fundamentals right in terms of having visibility of and centralising information to answer some key questions: where are the gaps in data coverage?, which are the best and worst performers in the portfolio?, What’s the current status of asset action plans?, Where in the portfolio should action be prioritised for improvement on each of these?

Undoubtedly technology plays an essential role here as a tool to drive efficiency and consistency in the data collection process and to centralise that data. However, ultimately this comes down to providing an easy and simple means of engagement and collaboration between Asset & Investment management and Property Managers.

We have developed SIERA+ to better equip property managers in engaging with ESG and addressed the priority needs; provide a simple view on performance against targets, ability to manage data quality and keep on top of actions. Notifications prompt when action is required and it’s generally set up to let users focus on the most material issues.

We also recognise that the culture of Property Managers can vary across diverse portfolios and English is not always the first language. Since this is about improving engagement we have made SIERA+ available in 5 languages.

Get in touch to know more.