Get to Grips with GRESB

Address sustainability challenges with GRESB reporting to attract responsible investment.

GLOBAL REAL ESTATE SUSTAINABILITY BENCHMARK – GRESB

Highlight Transparent Sustainability Performance

Real asset investors face mounting pressure to embrace sustainable practices and transparently communicate their progress and performance to stakeholders.

GRESB provides a robust framework to help you mitigate risks, safeguard reputation, and protect asset value in the face of evolving market and regulatory conditions.

Guide

Download EVORA’s Guide to GRESB

GRESB guidance from the team behind hundreds of successful submissions

Mitigate

Risk

EVORA identifies sustainability risks early, ensuring compliance and resilience.

Protect

Asset Value

A GRESB submission with EVORA leads to optimised operations and better scores, attracting investment.

Safeguard Reputation

Our expertise helps you avoid reporting gaps that could impact investor confidence.

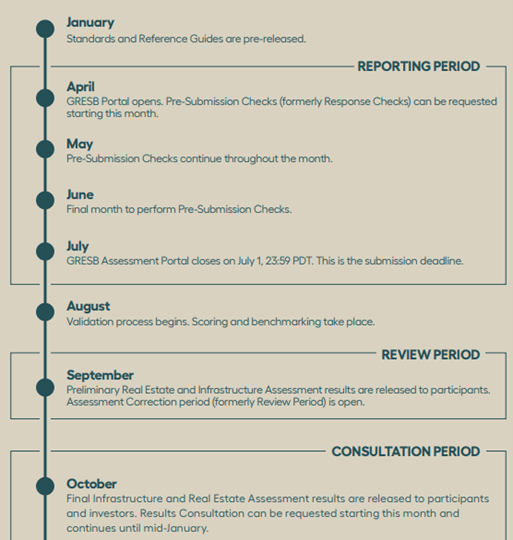

GRESB TIMELINE

Optimising GRESB Performance

with EVORA’s

Expert Support

EVORA works closely with you and your team, from collecting and verifying your energy, water, and waste data on our data management platform, SIERA, to analysing your performance and uploading your submission directly to the GRESB portal.

We also conduct a GRESB review to forecast your score before the final release in October and perform a post-GRESB review to identify areas for improvement and strengthen your score for the following year.

PROVEN RESULTS

GRESB 2025: Powered by EVORA

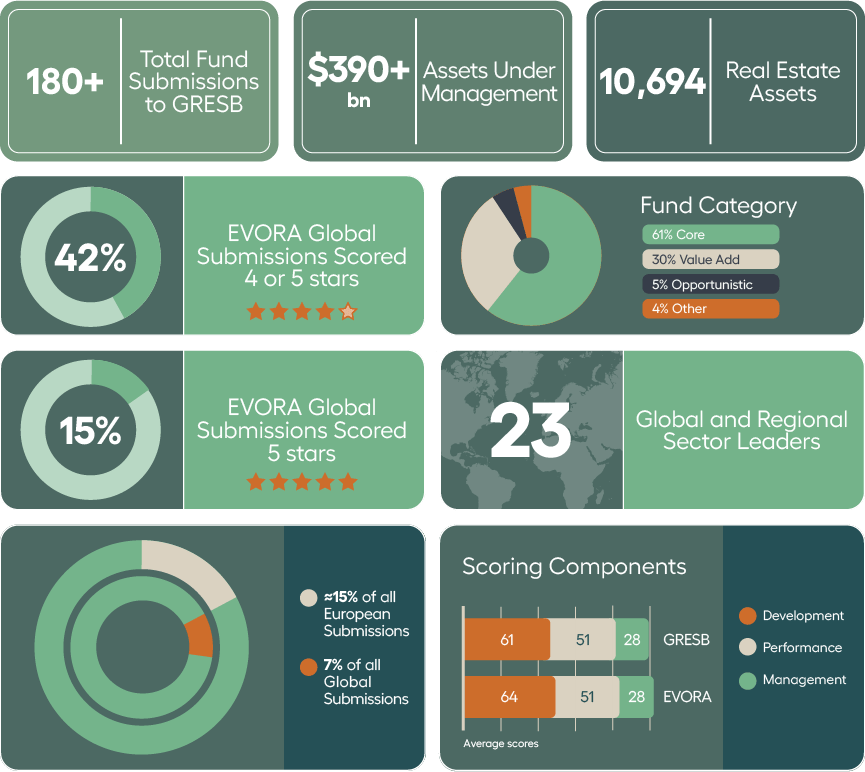

In 2025, GRESB received reports from 2,382 real estate and 805 infrastructure participants globally.

Of these, EVORA supported over 180 fund submissions, representing more than $390bn in AUM.

This accounts for around 15% of all submissions in Europe and 7% globally — with 15% achieving 5 stars and 42% scoring 4 or 5 stars.

23 of the funds supported by EVORA have been recognised as Global and Regional Sector Leaders.

THE EVORA OFFERING

Providing a variety of packages to suit your needs

-

GRESB Gap Analysis

A comprehensive review of your asset/fund’s current position against GRESB survey requirements, helping you identify and implement targeted improvements for both Management and Performance components.

-

GRESB Performance Reporting Support

Use of our data management platform, SIERA, to aggregate and validate your GRESB data, with EVORA’s expert review to optimise your score.

-

GRESB Full Reporting Support

A comprehensive submission support program, covering materiality assessment, data collection, GRESB portal upload, results review, and an improvement roadmap presentation.

Our customers’ voices

SUBMITTING TO GRESB

Struggling with GRESB data collection?

We handle it.

Gathering data is a crucial part of the reporting process, and data availability plays a significant role in your GRESB score. The higher the percentage, the greater the potential score.

With the assistance of our experts and our own software, SIERA, EVORA helps streamline the process to ensure a successful GRESB score.

DATA COVERAGE

Facilitating Automated

Data Collection

With over 17 billion data points under management and a global network of data sources, EVORA offers one of the most comprehensive automated data collection solutions in the industry. We continuously integrate new utility providers and hubs, providing instant global access through automatic invoice parsing.

Our system processes incoming data continuously and automatically, while also collecting any historical data your buildings have generated over the years. This ensures a seamless setup, allowing you to start using our data collection services with minimal delay.

DIVE INTO THE DETAILS

Q&A

Below are some of the top questions we hear from real asset professionals. If you have any other questions, reach out and we’ll be happy to help.

GRESB 2025

Staying ahead of the curve

The upcoming 2025 GRESB standards is set to raise the bar on data verification, renewable energy procurement, and embodied carbon, especially for large entities and infrastructure assets.

EVORA helps you stay ahead by ensuring your data is audit-ready, aligned with the latest sustainability methodologies, and supports enhanced transparency, stronger documentation, and adaptation to evolving standards.