Thought

Anticipating Actions and Metrics for the EU Social Impact Investment Taxonomy

In partnership with the University of Leeds, EVORA have been conducting extensive research into how social impact can be measured, in anticipation of the EU Social Impact Investment Taxonomy due for release in September 2021.

The increased profile of the ‘S’ in ‘ESG’ is driving demand for a standardised and established set of key performance indicators (KPIs) and metrics, against which funds can evaluate the progress and success of their social impact policies.

The ‘S’ of ESG

Social sustainability is commonly thought of as an ambiguous topic. This has led to a considerable gap in understanding how social impact can be integrated into ESG strategy with the same clarity as its environmental and governance counterparts.

As a result of limited resources, such as a clear framework and material metrics, social impact in ESG programmes is often overlooked. The result of this, is limited engagement from organisations in how they plan for, deliver, measure and report social impact.

Since the implementation of the Public Services (Social Value) Act, 2012 in the UK, private-sector uptake of social sustainability in the built environment has been both rapid and largely voluntarily. The Act only required that local authorities consider social value in procurement. Simultaneously, UK real estate managers became leaders in the implementation and measurement of social impact programmes.

In September 2021, the EU Commission plans to publish their Social Impact Investment Taxonomy. It is fair to anticipate that uptake in social impact programmes will mirror that of the UK in 2012.

Europe, therefore, face a challenge due to a lack of practical European-focussed guidance on social sustainability.

EU Social Impact Taxonomy

The Social Impact Investment Taxonomy will provide an opportunity for European investment organisations to develop a commercial response to current socio-economic risks. By clearly considering their social impact, funds can build their sustainability profiles and attract potential further investment.

Social Impact Metrics

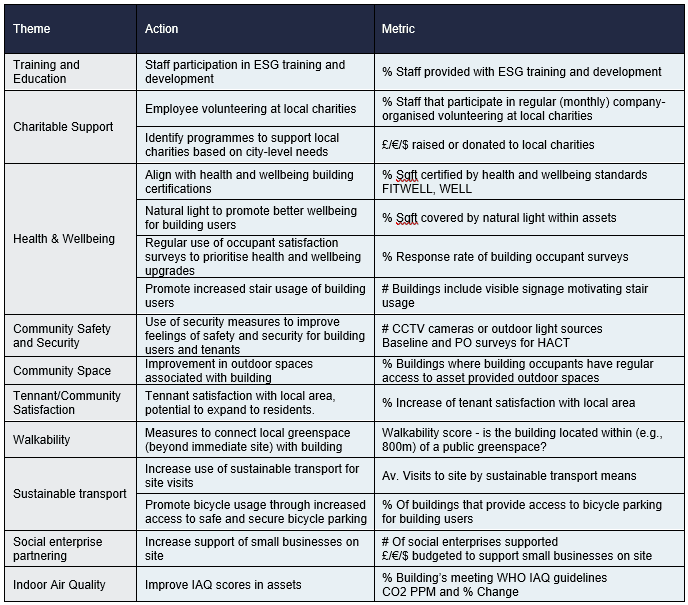

The EU Social Taxonomy does not currently provide a clear framework and metrics for implementing and measuring social impact. Therefore, in anticipation of the increased interest in social impact and the built environment across Europe, EVORA have worked with the University of Leeds to research how learnings from tried-and-tested social impact programmes and metrics in the UK can be applied in Europe. These may facilitate discussions within your ESG team on how to practically address interventions and reporting in areas such as:

- Training and Education

- Charitable Support

- Health and Wellbeing

- Community Safety and Security

- Community Space

- Tenant satisfaction

- Sustainable Transport

- Social Enterprise Partnering

- Health and Wellbeing aspects such as indoor air quality

The most important aspect of these metrics is that they go beyond the use of quantifying inputs and aim to recognise people as the end users of social impact programmes themselves.

EVORA is grateful to Gemma Graham for her dedication to, and assistance with, this research.