Case Study: BELGRAVE HOUSE

Environmental Management System Delivers 19.3% Reduction in Electricity Consumption Over Three Years

The Challenge

Belgrave House is a large, high profile office building in Central London which is managed by our client, BNP Paribas. In 2011 they were tasked with introducing an Environmental Management System (EMS), achieving ISO 14001 and using this approach to implement environmental performance improvements.

EVORA Global was appointed to support the project and now, over a decade after our initial instruction, we remained engaged.

Our Approach

ISO 14001 requires implementation of a risk-based approach. There is a requirement to identify and evaluate significant environmental risks (or aspects and impacts). Programmes must then be put in place to control risks and improve associated performance, wherever possible. Our initial assessments clearly identified energy use as both a significant risk and opportunity.

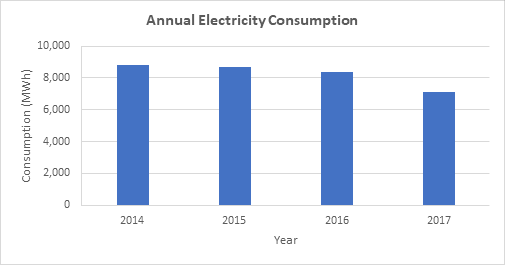

Work completed by the Belgrave House General Manager and his team has been fundamental in delivering success. This demonstrates that technology alone is not the answer. Success, shown in the chart below and within our Key Outcomes section, has been delivered through both the application of technology and the roll-out of simple no and low-cost measures.

Belgrave House has continued to have success. In summary, projects implemented, through the EMS, to improve environmental and energy performance have included:

- Installation of LED lighting and improved controls

- Installation of three phases of solar photo-voltaic (PV) panels to the roof

- Significant revisions to building management system (BMS) settings

- Comprehensive staff and contractor training

- Implementation of a tenant engagement programme

Key Outcomes

Performance in 2017 was outstanding. Electricity consumption fell, when compared to 2016, by 1,278,000kWh – a reduction of 19.3%. This generated cost saving of approximately £127,800. It is also important to note that occupancy remained at 100% during both years. In short, savings achieved were down to the EMS and not a result of changing building use patters.

In the same period, gas consumption also fell by almost 175,000kWh (-12.7%). Weather impacts significantly on gas use. 2017 was warmer than 2016 and we had a milder winter. Nevertheless, 8.8% reduction was still achieved when changes to weather conditions were factored into our calculations.

Over a longer period, electricity consumption has fallen by 1.7 million kWh, when compared to 2014 and by almost 2 million kWh per annum when we go back to 2011. This has resulted in cost savings of approximately £200,000 per annum. Associate carbon emissions have also fallen.

For the benefit of all…

EVORA Global and the building management team worked closely to ensure benefits were delivered to the following key stakeholders:

- Tenants – who benefit from reduced energy consumption, associated costs, and a knowledge that the building is being run efficiently and in line with environmental legislative requirements.

- The Owner – who benefits from the knowledge that the building is being effectively managed, is compliant with legislation and is future proofed against potential rising utility costs.

- Employees & Contractors – who benefit from enhanced training and awareness of environmental related issues. Everyone who uses and works at Belgrave House is actively encouraged to contribute to the sustainability of the building.