Thought

Review of the latest PRI Reporting Framework

The 2021 PRI reporting cycle for investor members went live on the 1st of February. There are some major changes to this year’s framework including a significant scoring recalibration and overhaul of the assessment methodology. So, with the deadline of the 29th of April looming, signatories may be asking: Why has the framework changed? What are the most significant changes to the reporting framework? And who must report during this year’s cycle?

Why has the framework changed?

The latest reporting framework comes as a result of the PRI’s 10-year blueprint for responsible investment following an extensive review of the reporting and assessment framework between 2018 and 2020. Perhaps most significantly the review highlighted that in 2018, 165 of its investor signatories did not meet the three minimum PRI requirements. This resulted in the public delisting of five of these signatories in 2020.

The blueprint acts to promote signatories accountability in upholding their PRI commitments and cannot merely use their membership status to amplify their public image, commencingwith this release of a more evolved and challenging mandatory assessment.

Signatories may face de-listing in the long-term should they not complete the assessment in line with the blueprint.

What are the most significant changes to the reporting framework?

The new 2021 reporting framework has three core aims:

- To become more evolved and challenging;

- To ensure signatories gain an improved and more flexible output at the end of the reporting cycle;

- To relieve the reporting burden by making the framework simpler, shorter and less repetitive. The number of indicators has been cut by 50% since previous years assessments.

The scoring system has moved away from overall organisation alphabetical grading (A+ to E) and will be replaced by a new numerical grading system ranging from 1 to 5 stars, allocated per module.

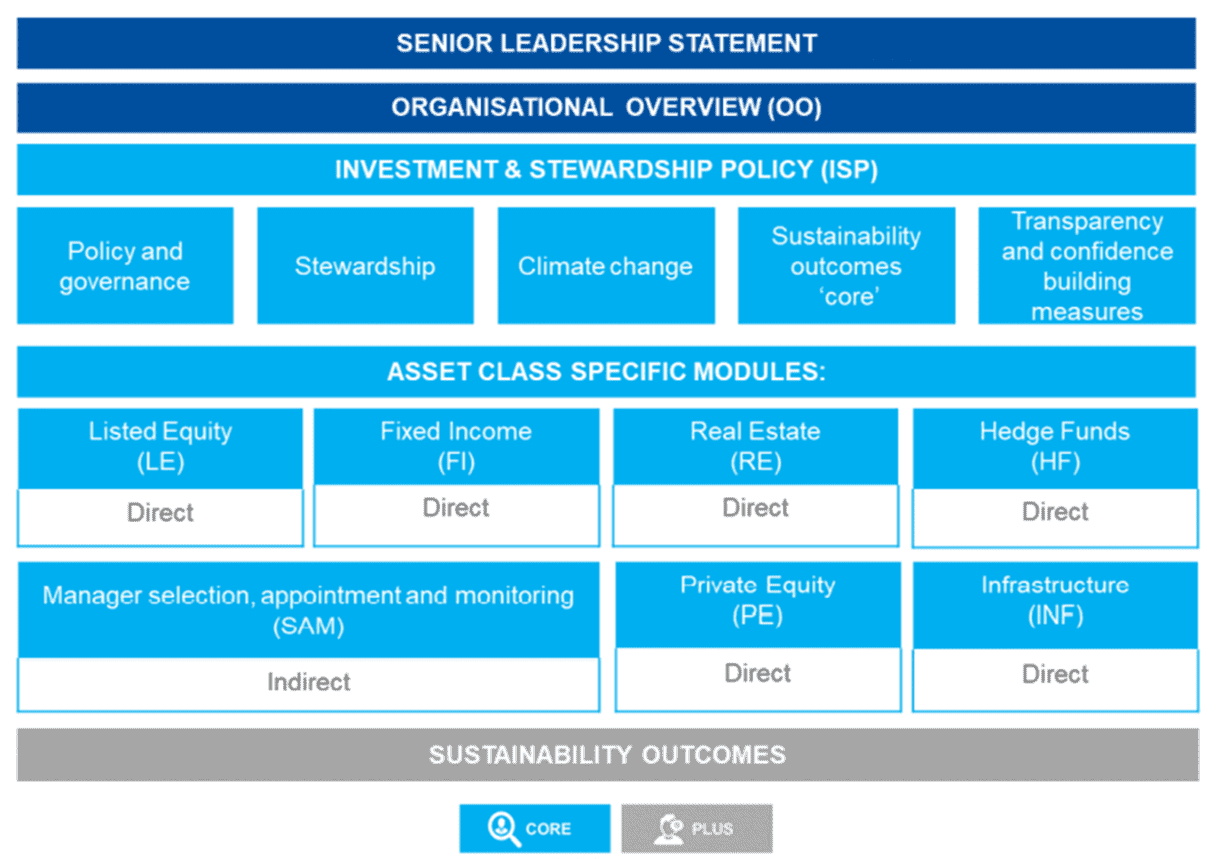

In the new framework, most indicators have changed, and a number of new modules and indicator themes have been introduced, see below.

The new framework starts off with two mandatory initiation modules, the ‘Organisational Overview’ module and a new ‘Senior Leadership Statement’. This leadership statement provides signatories with an opportunity to introduce themselves, their responsible investment approach and progress towards their objectives during the reporting year.

The former ‘Strategy and Governance’ module, now named ‘Investment and Stewardship policy’, is where the most significant changes to the framework have occurred. The new module has fully integrated the concept of stewardship, supporting PRI’s latest guidance on active ownership.

The climate change module has been fully integrated into the main investment and stewardship policy question set. For the first time several of these indicators, aligned to the Task Force on Climate-related Financial Disclosures (TCFD), will be publicly disclosed and contribute towards the signatories rating.

Finally, a new set of core ‘Sustainability Outcomes’ indicators has been implemented. These indicators focus on organisation-wide guidelines and processes that enable the achievement of real-world sustainability outcomes.

If signatories have greater than 10% or $10bn AUM in a certain asset class, that module should be responded to.

The 2021 framework involves only two indicator styles. ‘Core’ indicators are mandatory, publicly disclosed and assessed. ‘Plus’ indicators are voluntary, will not be publicly disclosed and do not contribute towards the signatories score.

Who must report during this years cycle?

Annual reporting is compulsory for all PRI signatories to maintain signatory status unless they are within their 1st year grace period. Within this one-year grace period, the first reporting cycle is voluntary and reports are not publicly available. EVORA advise that new signatories take advantage of this opportunity to improve understanding of the reporting process, identify gaps in the present strategy and inform decision-making processes.

The new framework will no doubt prove to be a challenge for many new and old signatories, but as the PRI strives to act as a driving force for change within the industry, this uplift in expectations will surely provide an incentive many organisations need to further integrate responsible-investment best practise into their own approach.