Thought

Insights into the GRESB Infrastructure Assessment and Key Changes for 2021

ByMatthew BrundleandNatalie Sinha.

Globally, the demand for public and private sector investment into infrastructure is growing, alongside increased demand for investors to have robust environmental, social and governance (ESG) information for managing risk and opportunities within their portfolios. Whilst Real Estate investments have benefited from a number of reporting frameworks and guidelines, historically, there has been an information gap for investors on the ESG performance of infrastructure assets.

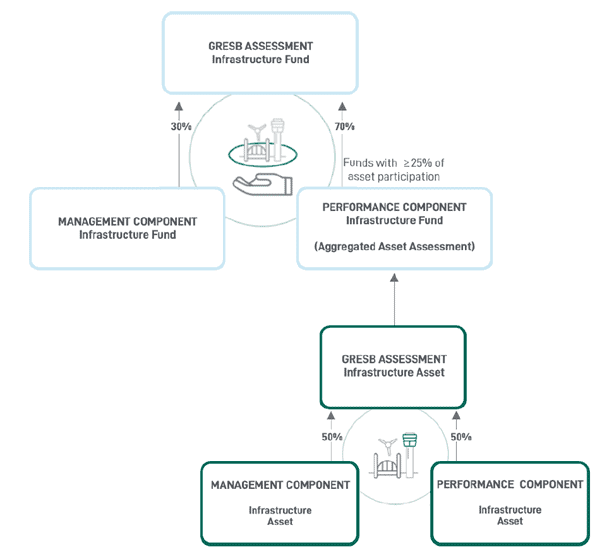

The GRESB Infrastructure survey was first launched in 2016, 5 years after its Real Estate counterpart. It provides a globally established tool to benchmark the ESG performance of infrastructure asset portfolios. The survey allows participation from a huge variety of sectors, including Utilities, Power Generation, Social Infrastructure and Transport amongst others. The annual survey consists of individual Asset Assessments which can be reported individually or consolidated into a Fund Assessment with other portfolio assets.

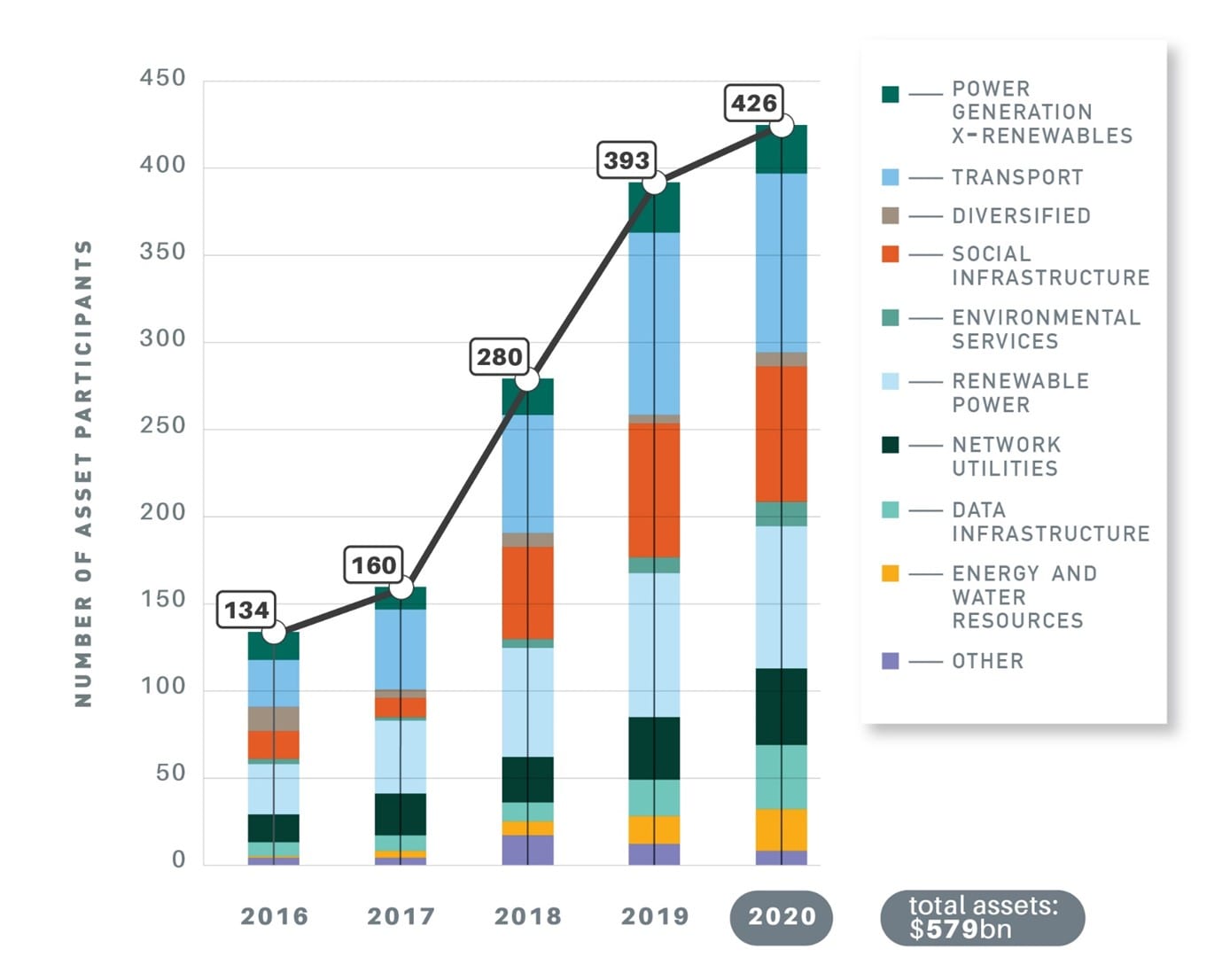

Since its launch, participation in GRESB infrastructure has grown substantially. In 2020, participation in the Infrastructure Fund Assessment increased by 10% year on year to cover 118 funds while the Infrastructure Asset Assessment grew by 8% to include 426 assets (2019: 393) with total AUM £579billion (see figure 1). Transport, Renewable Power and the Social Infrastructure sectors have the highest representation as these sectors historically attract greater public scrutiny. Data Infrastructure had the highest growth increasing from 21% to 38%, likely reflecting the growing importance of this sector in modernizing society and economies. Energy and Water Resources also grew significantly while most other sectors were stable.

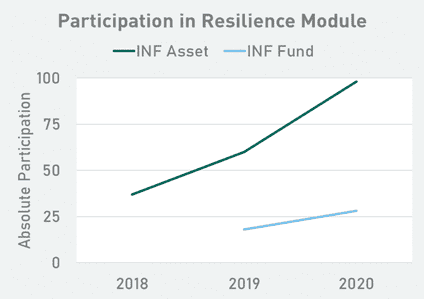

For the past three years GRESB has been trialling voluntary reporting in its new Climate Resilience module, recognising the importance of this topic. Reporting to the Resilience Module has steadily increased with 126 funds and assets participating in 2020. From 2021 onward it will become a mandatory scored module as GRESB seeks to align the scheme with both UN PRI requirements and the recommendations of TCFD.

GRESB Infrastructure Overview

The GRESB Infrastructure Asset Assessment is split into two components: Management and Performance. In contrast to Real Estate, the scoring of the survey is largely determined by an initial ‘Materiality Survey’ which uses 17 questions to rank 46 ESG issues according to how relevant they are to the asset: high, medium, low or no relevance. Focusing on the materially relevant ESG areas is necessary to create peer groups for comparative assessment in such a broad investment category. In parallel to the Real Estate Survey, the Management section covers areas such as Leadership, Policies, Reporting, Risk Management and Stakeholder Engagement. The Performance component awards points for data reporting of metrics which are determined as relevant issues through the materiality survey.

Changes to GRESB Infrastructure 2021 and the Integration of the Resilience Module

GRESB have pre-released the questions for the 2021 Infrastructure survey, for both the Fund and Asset level assessments as well as an overview of the key indicators. For 2021, the Infrastructure Assessments have been kept stable with relatively few changes. The scoring mechanisms for the Fund and Asset surveys have now been released, ahead of the reporting window opening in early April 2021. Initially, GRESB intended to add a Development Component into the Asset Assessment, to enable better reporting and benchmarking for assets (projects) in development (in design or construction). However, this is no longer going to be incorporated into this year’s survey but may be introduced in 2022.

The most substantial change is that the Resilience Module, which was optional in previous years, has been integrated into the Assessments and is now mandatory. These questions have been incorporated into both the Fund and Asset level assessments. This change helps facilitate Taskforce on Climate Related Financial Disclosures (TCFD) aligned reporting for all participants. Although these questions are not currently scored, this is likely to change in future years. The following five new indicators on Resilience have been added to the Risk Management section:

| Indicator | Question – Climate-related Risk Management |

| RM3 | Resilience of strategy to climate-related risks Does the entity’s strategy incorporate resilience to climate-related risks? If yes: Does the process of evaluating the resilience of the entity’s strategy involve the use of scenario analysis? |

| RM4.1 | Transition risk identification Does the entity have a systematic process for identifying material transition risks? (Policy and Legal, Technology, Market, Reputation) |

| RM4.2 | Transition risk impact assessment Does the entity have a systematic process to assess the impact of material risks on the business and/or financials of the entity? |

| RM4.3 | Physical Risk Identification Does the entity have a systematic process for identifying material physical risks? |

| RM4.4 | Physical risk impact assessment Does the entity have a systematic process for the assessment of impact from material physical climate risks on the business and/or financials of the entity? |

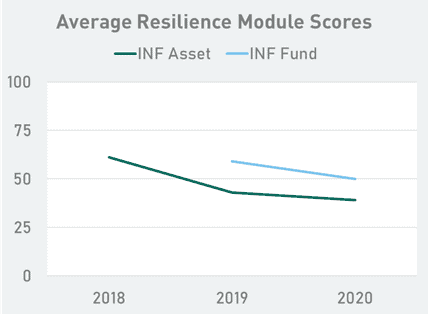

These questions will mean that Infrastructure assets and funds need to begin to understand how they will be impacted by physical and transitional climate change risk. In GRESB 2020, there was a 60% growth rate in assets and funds reporting under the voluntary Resilience module (figure 4, below). However, there was a reduction in the average scores achieved (figure 5). GRESB analysis concluded that this was due to increased reporting, but it signals that respondents found the questions challenging. This is likely to be the case in the GRESB 2021 reporting window when the questions are made mandatory.

EVORA considers it is likely that further climate resilience questions will be incorporated into the GRESB Infrastructure survey in future years, and therefore it is imperative that Infrastructure investors and operators start by carrying out a gap analysis of their existing funds and assets in line with TCFD requirements. This requires engaging all areas of the business to understand the implications of climate risk and opportunities, followed by the development of a roadmap towards full TCFD alignment. In terms of full TCFD disclosure, GRESB submissions in themselves will not suffice: a separate risk appraisal and forward-looking analysis is required.

Key challenges for participants

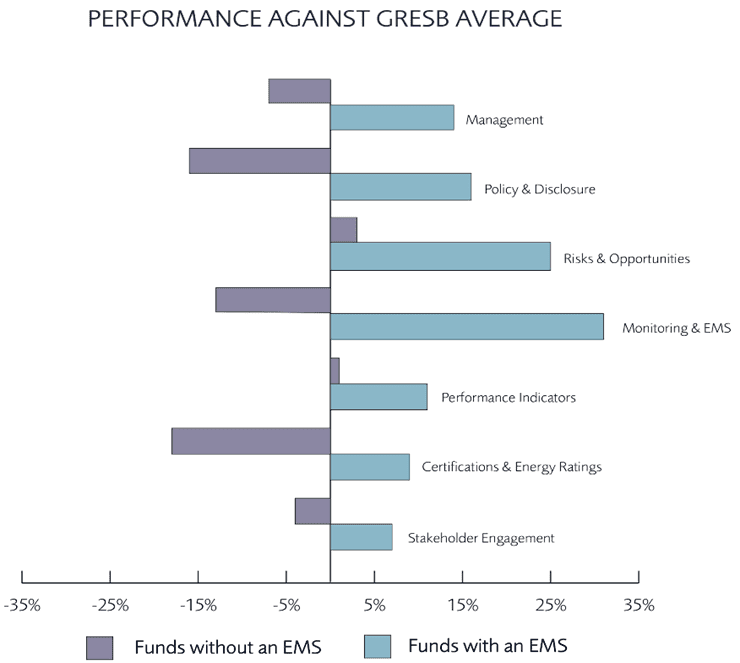

A core component of successful environmental management involves having structured Management Systems. Figure 3, below, shows that the GRESB performance of funds which have active Environmental Management System programmes score consistently higher across the performance themes. This highlights the importance of applying EMS principles to infrastructure assets and funds.

One observation we have made from working with infrastructure assets is that, due to complex investment structures, assets tend not to have asset specific Management Systems, with a tendency to rely on corporate level commitments and documentation to drive ESG issues. This potentially leaves assets passively managing ESG and not proactively driving forward improvement plans. Historically GRESB has simply encouraged assets and funds to acknowledge ESG as an issue and awarded points accordingly. However, each year the scheme progressively tightens its requirements by awarding points for demonstrable improvements in performance and having long term improvement targets. Therefore, having a dedicated ESG programme active at asset level will soon become the essential for GRESB success.

EVORA has been providing GRESB support since its inception and we are proud to be GRESB Global Partners. Our experience has shown us that clients who proactively engage with the process of GRESB each year, by using it to continually drive ESG improvements over time, do the best. EVORA therefore encourage all participants to consider GRESB as ‘a journey, not an event’.

Performance data for Infrastructure assets

GRESB are making strides in the right direction by beginning to incorporate questions on climate resilience aligned to TCFD, but the existing survey is not infallible. The current Infrastructure survey is particularly strong on the Management section, however the Performance section, which tracks numerical data, does not currently require evidence to be submitted or data assurance. At EVORA, we advocate a further drive towards assured performance data to ensure the data is reliable, accurate and externally verified. This will add extra credibility to the overall survey.

In contrast, the Real Estate survey requires tools for data management to ensure integrity and quality. Data management is so important that EVORA developed its own software platform, SIERA, to help dynamically manage data collection, and provide quality checks and validation. We envisage data within the infrastructure survey requiring a similar data intelligence tool to manage data flows which will bring parity between the two schemes.

A further point of note is the subtle but necessary move from simple retrospective data reporting to predictive scenario analysis. This switch is most notable for forecasting pathways to Net Zero, which has become essential for forward-looking investors seeking to align to Paris Climate Change Agreement. But is also beginning to be applied to other ESG themes for those wishing to deliver against UN SDG’s as GRESB have introduced some new impact reporting questions into the 2021 survey. In respect of Net Zero Carbon pathway modelling, Real Estate can use the Carbon Risk Real Estate Monitor (CRREM) tool to assess asset stranding risk. However, there is currently no equivalent tool for Infrastructure, despite the fact significant decarbonisation will be required for Infrastructure assets and funds.

GRESB Infrastructure Public Disclosure

GRESB has recently partnered with the Global Listed Infrastructure Organisation (GLIO) and have launched a new ESG Index (January 2020) [1], which is being introduced this year. The index is the first of its kind and intends to address ESG issues in the investment process to gain a deeper insight into the risks and opportunities that materially impact the value and performance of infrastructure investments. GRESB Infrastructure Public Disclosure is unique in its focus to measure only material ESG disclosures by listed infrastructure companies and vehicles. The evaluation is based on a set of indicators aligned with the GRESB Infrastructure Asset Assessment, allowing for a comparison of ESG disclosure performance between GRESB participants and select non-participants. It also provides investors with a resource hub to access ESG disclosure documents across their full investment portfolio.

With the index comes the need for increased transparency and information around listed infrastructure ESG performance, and it can be assumed the two schemes will progressively align to drive integrated financial and ESG reporting. GRESB have released guidance on the Infrastructure Public Disclosure, which explains how it works alongside the annual survey, with similar timelines for data collection, validation and results.

GRESB Infrastructure Public Disclosure data is initially collected by the GRESB team for selected companies, including the entire GLIO Global Coverage Index as well as both 2020 GRESB Infrastructure Asset Assessment participants and non-participants. It consists of four Aspects: Governance of Sustainability, Implementation, Operational Performance and Stakeholder Engagement. Together, these Aspects contribute towards a Public Disclosure Level, expressed through an A to E sliding scale. The index includes 30 indicators, covering four Aspects. Each indicator is scored between zero and full points, depending on the availability of evidence and selected answer options. Combined, these indicators add up to a maximum of 100 points. Constituents receive a GRESB Infrastructure Public Disclosure Level, from A to E, based on the following scale:

| GRESB Infrastructure Public Disclosure Level | Number of points received | GLIO/GRESB Index Band |

| A | 80-100 | 90-100% |

| B | 60-79 | 70-80% |

| C | 40-59 | 50-60% |

| D | 20-39 | 30-40% |

| E | 0-19 | 10-20% |

The scheme is brand new but marks an initiative in the market which will, in time, improve ESG data quality enabling investors to have greater surety of asset and fund performance. The index is free to register and use for all GLIO or GRESB members. Further information on the index can be obtained here.

Future directions for GRESB Infrastructure

GRESB have stated that they will continue to shift the emphasis and scoring from management and transparency to performance to meet the needs of the investors and society. The annual survey is expected to track and respond to the wider ESG landscape, which comprises legislative changes such as the latest EU regulations, including sustainable finance (SFDR). This also includes initiatives and global agreements such as the UN Sustainable Development Goals. These drivers of change are already embedded into GRESB and will continue to gain greater prominence within the future schemes. Impact and outcome reporting are also expected to become a future area of performance measurement and asset differentiation, for which many infrastructure assets are well placed to achieve good outcomes.

There is no doubt that the GRESB Infrastructure survey will continue to grow in importance and provide valuable ESG information to investors. The addition of the GRESB Infrastructure Public Disclosure adds a new dimension to the scheme, placing emphasis on publicly available information. Infrastructure Assets and Funds will be required as a minimum to have well-established Environmental Management Systems in place with targets for improving their performance, as well as looking towards more mature sustainability strategies which incorporate climate resilience and TCFD alongside the UN’s SDGs. GRESB reporting will continue to play a role in helping infrastructure assets in contributing to a more sustainable future, placing an increasingly high expectation on the sustainability approaches of participants.

If you would like to discuss GRESB Infrastructure or wider sustainability support, contact the team at infrastructure@evoraglobal.republiken.se

[1] https://www.glio.org/esg