Thought

Decoding the TCFD framework: climate action in UK real estate investment trusts

In the UK, the Taskforce for Climate-related Financial Disclosures will spur Real Estate Investment Trusts to set and meet new climate-related benchmarks for climate action. The TCFD framework marks a significant step forward for increased transparency, accountability, and resilience in real assets.

What is the TCFD framework? And why does it matter?

In the current climate crisis, the real asset investment and building sector finds itself in a juxtaposition. On one hand, buildings are a major contributor to accelerating climate change, accounting for almost 40% of global greenhouse gas emissions. On the other hand, the building sector is vulnerable to the negative climate impacts because of their fixed nature and high cost of adaptation. This poses a unique challenge for real estate. Added to this, market pressures and regulatory mandates are forcing the real asset sector to address the challenges of climate risk.

The Financial Stability Board (FSB) set up the Taskforce for Climate-related Financial Disclosures (TCFD) to make climate-related issues and management more transparent – and to ensure recognition of related risks and opportunities in the financial sector. In 2017, the TCFD released a set of recommendations aimed at assisting organisations in enhancing their climate-related financial disclosures through their current reporting procedures.

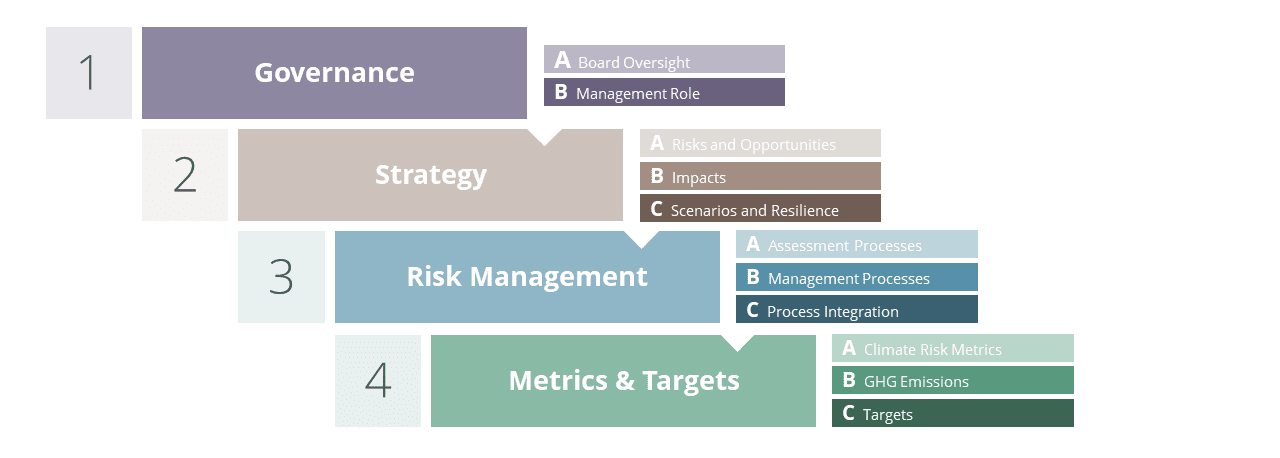

Structured around four categories and 11 recommendations, the TCFD framework beckons businesses around the globe to shed light on how they are responding to climate change and its impacts. Crucially, the TCFD focuses on disclosing how businesses will be impacted by, and adapt to, a changing climate. This is in addition to disclosing how they will reduce emissions to mitigate climate change.

How does the TCFD framework impact REITs?

As commercial real estate jolts into climate action, UK legislation now demands that certain businesses disclose information on how they account for climate-related issues when making investment decisions. For example, starting in 2022, publicly listed companies in the UK – like Real Estate Investment Trusts (REITs) – must disclose climate-related data in line with the TCFD framework.

This signifies a real step forward for increasing transparency and accountability within real assets in the UK. Investors are increasingly using disclosed data to assess business performance, evaluate potential risks and opportunities, and make more informed decisions about their investments. Many investors are also looking for real asset investments that align with their values. Here, transparency is key for responsible and sustainable long-term benefit.

Are businesses disclosing a wide coverage of data to maximise transparency?

To better understand business approaches to transparent Governance, Strategy (Strategic Decision-Making), Risk Management, and Metrics & Targets (Performance Monitoring), the Climate Resilience Strategy & Disclosure Team at EVORA Global analysed the mandated disclosures of 54 publicly traded UK REITs in June 2022.

This research coincided with the TCFD framework’s annual 2022 Status Report, enabling our team to benchmark key findings against climate disclosure trends for larger institutions. We compared this disclosure information against the TCFD framework’s 11 recommendations and best-practice guidelines to evaluate the extent of their coverage and completeness. Here are our key findings for REIT Climate Disclosure Coverage.

- Overall disclosure – coverage

- Most of the businesses disclosed information by June 2022, meeting the deadline (70%)

- Around half of the businesses disclosed against 10 or 11 recommendations (54%)

- Only two of the businesses disclosed less than 6 recommendations

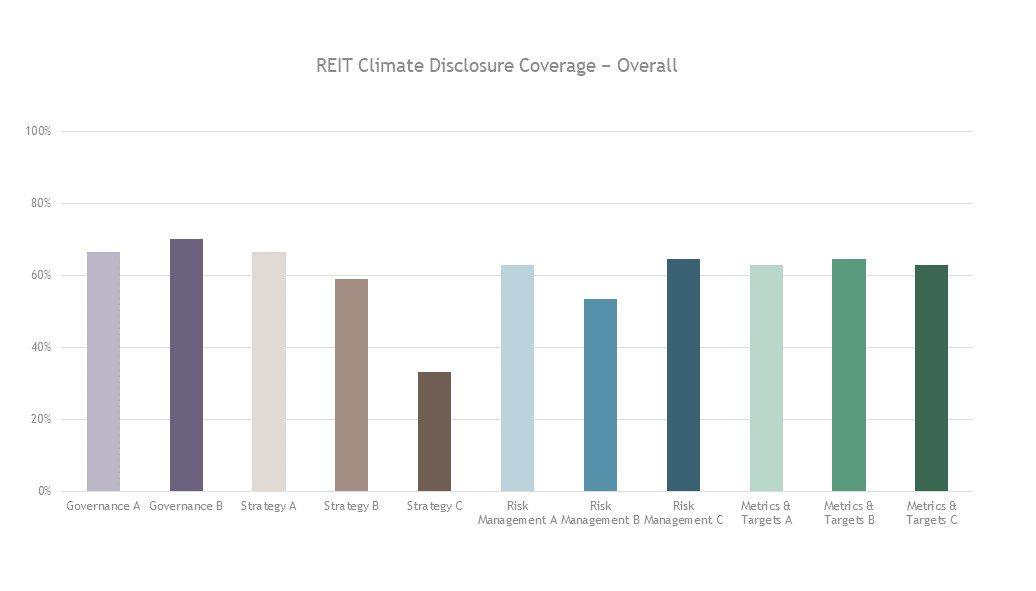

- Category disclosure – coverage

- Around two thirds of the businesses disclosed data on Governance (69%) and on Metrics & Targets (64%)

- Almost two thirds of the businesses disclosed data on Risk Management (61%)

- Around half of the businesses disclosed data on Strategy (53%)

These findings demonstrate that businesses are mostly aware and prepared to disclose data related to the TCFD framework, with more than half disclosing 10 or 11 recommendations. A majority also disclosed all four categories, indicating a willingness to comply with the TCFD framework. Only a small number of businesses disclosed less than 6 recommendations and/or excluded a less familiar Strategy C recommendation, which is reliant on first conducting a technical Climate Scenario Analysis.

Are businesses disclosing investment-grade data to maximise credibility?

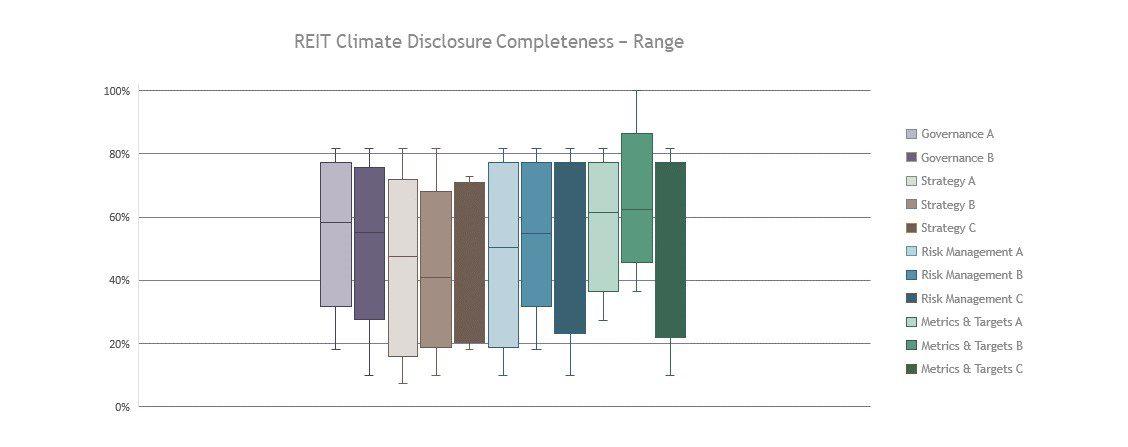

We also evaluated the quality of the disclosure coverage against the TCFD framework’s 11 recommendations to determine its completeness. High percentage scores signify high-quality data. Here are our key findings for REIT Climate Disclosure Completeness.

- Overall disclosure – completeness

- The categories for complete disclosure, ranked in order from most to least, were Metrics & Targets, Governance, Risk Management, and Strategy.

- Across almost all 11 recommendations, scores widely ranged: from 41% (Strategy B) through to 62% (Metrics & Targets B)

- Scores ranged < 20% for almost all recommendations

- Scores achieved around 80% for all almost recommendations

- Metrics & Targets B was the only recommendation to record total completeness

- Category disclosure – completeness

- Metrics & Targets topped the chart (59%)

- Governance came a close second (57%)

- Risk Management lagged slightly (53%)

- Strategy proved the trickiest (46%)

Front-runners and laggers in the race for TCFD completeness

On average, businesses exhibited mediocre levels of disclosure completeness, with scores ranging from 41% to 62% across the TCFD framework’s 11 recommendations. The most comprehensive disclosures were made against Metrics & Targets, with over 60% completeness in two out of three recommendations. In contrast, disclosures related to Strategy wallowed below 50%. Governance and Risk Management disclosures nestled in-between, with scores ranging from 50% to 58%.

Completeness scores ranged widely across almost all recommendations, with scores varying greatly from below 20% to around 80%. This suggests that disclosure practices are inconsistent among businesses – and highlights the need for greater standardisation and improvement in this area.

It’s clear more ground needs to be covered to achieve complete disclosure. On average across all 11 recommendations, businesses are only disclosing half of the information recommended by the TCFD framework. And the lack of consistency is reflected in the broad range of scores per recommendation, with completeness scores for all recommendations starting below 20% (except Metrics & Targets A and B).

Metrics & Targets B achieved a maximum score of over 82%, with the Metrics & Targets category achieving the highest average completeness score at 59%. This is likely due to the real estate industry’s experience and existing best practices for collecting climate-related environmental and sustainability data, especially for energy consumption and carbon footprints.

However, even with this high score, there’s room for improvement for businesses to achieve complete disclosure. To reach this goal, businesses should expand their set of metrics to match the scope of climate risks and opportunities described in Strategy A, and set comprehensive targets to measure performance as recommended in Metrics & Targets C.

On the flip side, Strategy received the lowest average completeness score at 46%, with Governance and Risk Management only just edging ahead at 50% to 60%. One potential reason is that disclosing climate-related risks and opportunities can itself be a risk, particularly when there’s scant precedent to predict how the market and shareholders might react. Additionally, Strategy B, which asks businesses to disclose the material financial impacts of climate-related risks, achieved the lowest completeness score at 41%. This may be because this information can be challenging to define and calculate, and the information itself can be sensitive or open to misinterpretation if it’s not disclosed appropriately.

It’s important to keep in mind that middling average disclosures for completeness, combined with the wide range of scores observed per recommendation, could simply be because mandatory disclosure for UK REITs is in its infancy. And certain elements of the TCFD framework will be more relevant to some businesses than others, depending on their activities. It may not be relevant for all businesses to provide all the information recommended for disclosure. Plus, the lack of existing standard disclosures for the TCFD framework could have contributed towards the inconsistencies we observed between businesses disclosing against the same recommendations.

Where do businesses go from here?

Businesses have made positive strides in disclosing information about their ESG practices, but there’s always room for improvement. Most of the businesses made disclosures, but many were incomplete or inconsistent. Metrics & Targets achieved the most disclosed category, likely due to existing requirements for monitoring ESG metrics.

Overall, although progress has been made, businesses need to increase their efforts for consistency and completeness of disclosure to provide investors with the data they need to make informed decisions.

Discover how EVORA Global’s Climate Risk experts can leverage the TCFD framework to enhance the accuracy and comprehensiveness of your disclosures, resulting in a business that’s more transparent, accountable, and resilient.