Thought

Forward-looking ESG data

To integrate climate risk and sustainability into financial decisions, we need to standardise metrics, improve data quality and ensure that it is forward-looking as well as measuring past performance. For climate risk, this is an essential part of the TCFD Recommendations for integrating climate risk as an investment risk.

Climate risk is divided into three categories:

- Transition risk

- Physical risk

- Litigation risk

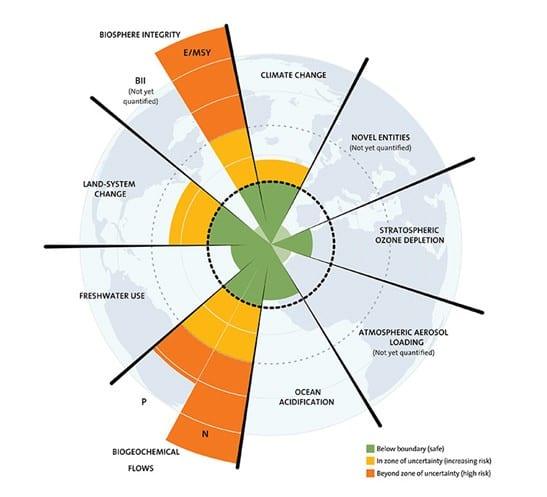

They all have forward-looking components. In ESG data terms, we can use historic data and data models to project future implications. We can do this more easily for the E in ESG because we know that we’re operating within planetary boundaries so we know there are limits. The Stockholm Resilience Centre (2015) monitors the nine planetary boundaries shown below.

Whilst this illustration doesn’t show us overshooting the climate change planetary boundary, that is because we haven’t yet. We are on track to do so with our present rate of greenhouse gas (GHG or carbon) emissions. That is why, in 2015, the UN Paris Agreement was signed by 195 states. This Agreement set us on a course to reduce emissions to Net Zero Carbon (NZC) by 2050, which keeps global warming well below 2°C, and ideally 1.5°C, to prevent catastrophic, non-linear climate change.

Over the last two years, many real estate companies and investors have committed to a Net Zero Carbon target and some have a pathway to get there. For most fund managers, they have not yet had time to project out a NZC pathway for their fund and real assets.

A science-based NZC pathway can show a clear route to reducing emissions each year. We need to be over halfway to NZC by 2030. However, local markets will move at different speeds depending on their starting point today; the local regulations; the cost of energy and carbon emissions; and, to some degree, the local awareness of a changed climate and how this forces climate adaptation. Climate adaptation will be required to protect against extreme weather events, which have become fiercer and/or more common over the past decade increasing insurance losses and premia.

These climate risks are the reason why ESG data needs to be forward-looking.

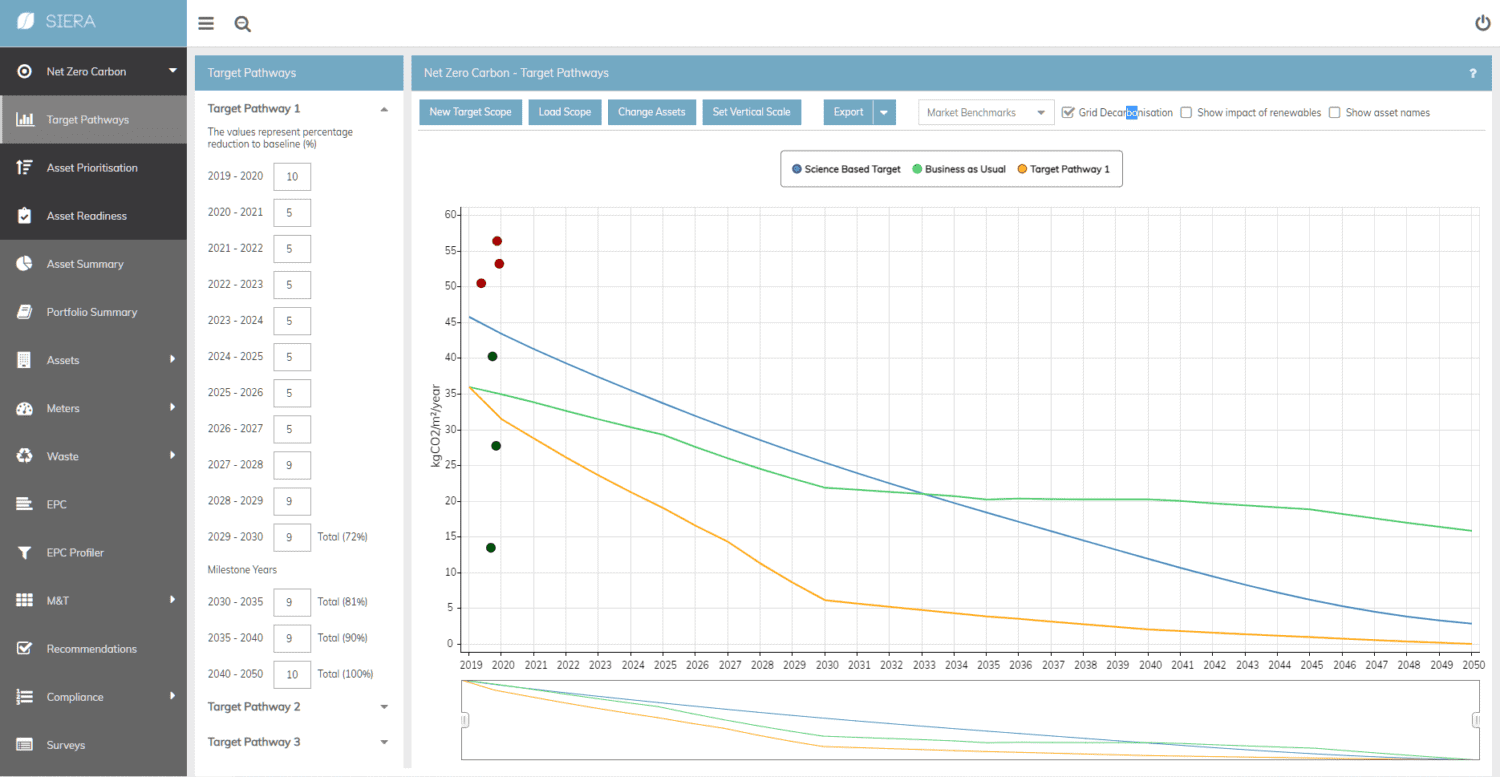

At EVORA Global, we have developed our SIERA software to be forward-looking on climate risk. We have worked on two new modules. The first is focused on NZC and transition risks and this is already available. The second builds on our partnership with Moody’s 427 physical climate risk assessment, which is used by our consultancy team. This will enable users to see both sets of climate risk in one place, associated with each asset and fund.

The screengrab below shows the NZC module, shows a real estate portfolio and the fund’s NZC pathway. This uses asset energy data from the last 9-12 months to calculate carbon emissions for the whole building. Based on asset type and location, it then automatically projects a science-based NZC pathway out to show the required emissions reduction. The tool can then be used to run different scenarios for emissions reduction based on what is know about each asset.