Turning Sustainability into Measurable Value

EVORA enables real asset investors and managers to reduce risk, protect asset value and strengthen investor confidence – through integrated consultancy, managed services and powerful investment-grade data & software.

We do not deliver sustainability in isolation.

We embed it into capital raising, acquisitions, asset performance and reporting – so it drives measurable financial outcomes.

Why this matters

The market has shifted.

Capital is selective.

Regulation is tightening.

Carbon performance now influences liquidity and exit value.

Funds that treat sustainability as compliance face:

-

Higher cost of capital

-

Brown discount and obsolescence risk

-

Weak investor narratives

-

Increased scrutiny during due diligence

Sustainability is no longer about reporting.

It is about investment performance.

EVORA ensures it is managed with the same rigour as financial performance.

The EVORA Difference

One partner. Full lifecycle capability.

Most firms offer advice. Others offer software.

EVORA integrates:

Consultancy

Specialist strategic, regulatory and investment advisory services across real estate and infrastructure.

We help you define strategy, analyse risk, assess assets, optimise performance and deliver investor-grade reporting.

Managed Services

Long-term delivery support across energy procurement, data acquisition, reporting cycles and asset optimisation.

Your sustainability functions are managed by a dedicated EVORA team, ensuring ongoing progress and resilience.

Software, Data & Analytics

Our platform provides a single source of truth across your portfolio – enabling automated data capture, analytics and reporting for SFDR, GRESB, CSRD and more.

Reliable, auditable data underpins and accelerates every part of your sustainability programme.

This combination is rare – and it matters.

Because strategy without delivery fails. Delivery without data lacks credibility. Data without context does not drive decisions.

We connect all three.

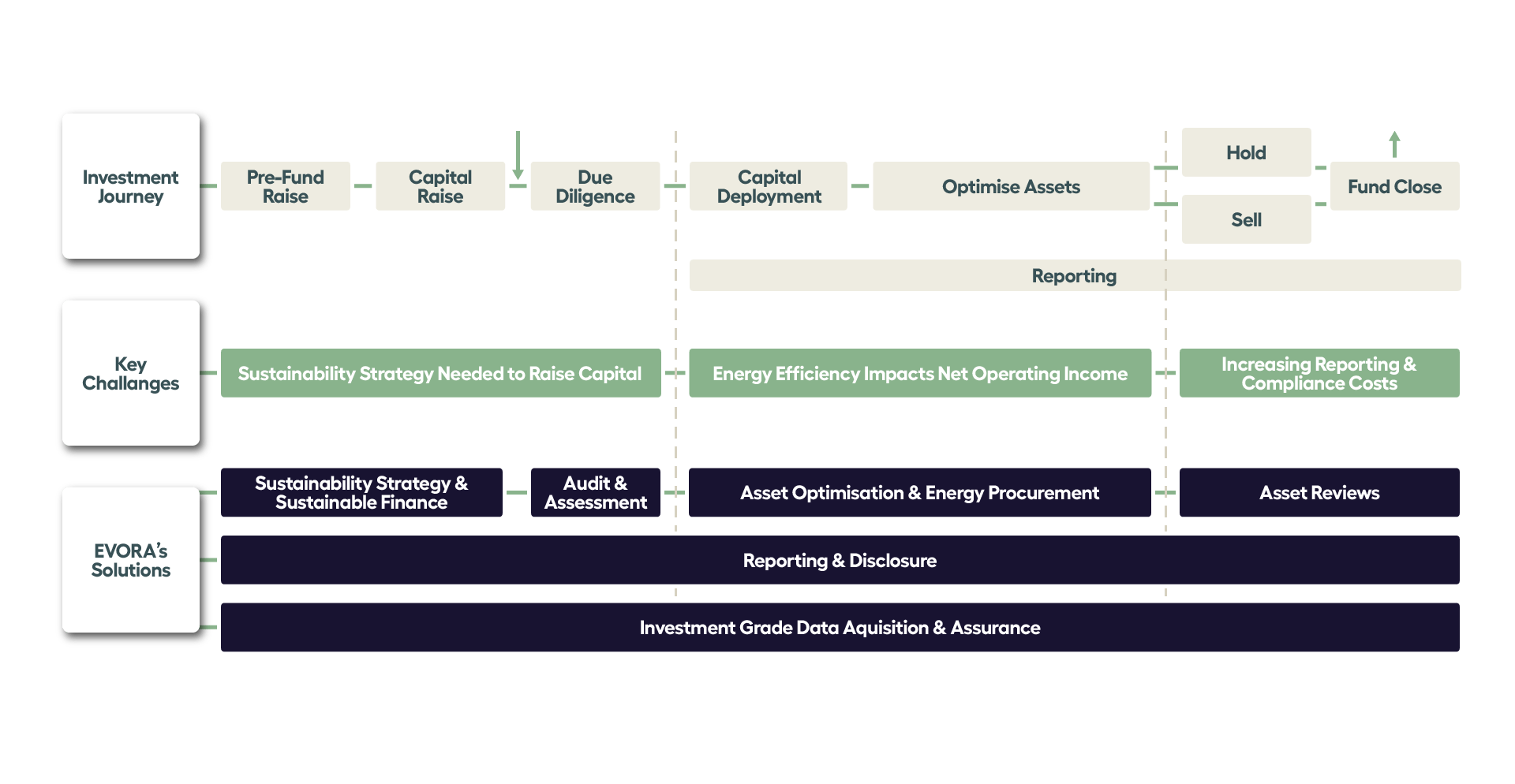

Support across the complete investment lifecycle

Sustainability must perform at every stage.

Sustainability Strategy >>>

Strategic sustainability positioning for funds and portfolios

Sustainable Finance >>>

Aligning capital structures with sustainability goals

Acquisition & Due Diligence >>>

Investment-grade diagnostics and risk assessment.

Asset Optimisation & Delivery >>>

Engineering-led decarbonisation and performance improvement.

Energy Management >>>

Portfolio-wide procurement and volatility control.

Reporting & Disclosure >>>

Audit-ready reporting aligned to investor and regulatory frameworks.

Software, Data and Analytics

Data alone is not a solution.

Insight is.

EVORA’s technology ecosystem underpins every stage of delivery.

EVORA’s Data Offering delivers complete, consistent and investment-grade sustainability, energy and carbon data across assets, portfolios and funds – managed end-to-end by our specialists.

We close data gaps, apply rigorous validation and maintain audit-ready standards — reducing internal burden while strengthening data integrity.

Reliable data becomes the foundation for reporting, analysis and confident investment decision-making.

SIERA provides a trusted, portfolio-wide sustainability data foundation – automated, traceable and audit-ready.

It standardises data collection, validation and reporting across global portfolios – creating a single source of truth aligned to regulatory and investor frameworks.

EVORA Analytics transforms that data into decision intelligence — enabling investment committees, asset managers and sustainability teams to prioritise risk, CapEx and optimisation actions with confidence.

Sustainability performance becomes measurable. Comparable. Actionable.

The Outcomes You Achieve

We focus on financial impact

Risk Reduction

Early identification of regulatory, climate and transition exposures.

Value Enhancement

Avoid brown discount, strengthen occupancy and support exit value.

Operational Efficiency

Targeted optimisation programmes delivering measurable cost savings.

Stronger Ratings & Credibility

GRESB, SFDR and regulatory performance that stands up to scrutiny.

Capital Access

Investor-aligned strategies that improve fundraising success and lender confidence.

Our customers’ voices

Sustainability must now perform like a financial discipline

If it impacts valuation, capital access and exit strategy — it requires investment-grade rigour.

EVORA delivers it.