Case Study: AEW UK

Sustainability Strategy Improves GRESB Scores Year-on-Year

“EVORA’s in-depth knowledge has provided us with expert end to end value driven solutions on sustainability. This is only enhanced through SIERA, with its powerful data reporting outputs that allow us to simplify the whole GRESB process.”

- Rachael McIsaac

The Challenge

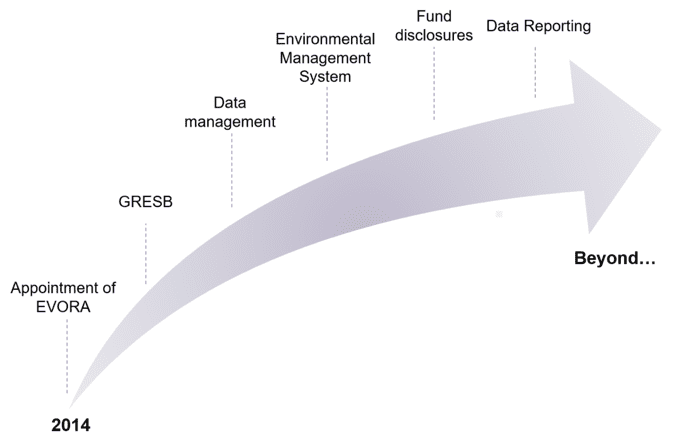

AEW is one of the world’s largest real estate asset managers, with AEW UK providing strategic solutions to institutional investors. Due to increasing investor demand and a recognition of the need for a coordinated approach to environmental management, AEW UK engaged EVORA Global to develop a bespoke sustainability strategy. Working in collaboration with AEW UK Asset and Portfolio Managers, EVORA developed a tailored strategy to effectively manage risks and opportunities across their UK portfolios.

Our Approach

EVORA Global developed a bespoke Environmental Management System (EMS) at corporate level for AEW UK. However, as the majority of risks, opportunities and potential savings stem from managed portfolios, the scope of the EMS was directed entirely at property and asset management activities. This approach enabled AEW UK to expand the scope of the EMS as new funds launched and existing funds grew.

EVORA Global developed a sustainability performance programme to gain a complete picture of trends across portfolios and down to asset-level through our powerful software system SIERA.

Key Outcomes

EVORA Global has enabled the client to operate a sustainability strategy based around the needs and requirements of AEW UK to achieve the following outcomes:

• GRESB – year-on-year improvement since 2014 for all returning funds

• Best Practice – development of an ISO14001 aligned system to demonstrate best practice to current and prospective investors and tenants

• Intuitive Reporting – sustainability data management/reporting for four funds through SIERA

• Investor Reports – produced fund level mandatory and voluntary sustainability disclosure reports

• Engagement – workshops run with both asset and property management teams to integrate best practices

• Policy – development of a new Socially Responsible Investment Policy