Thought

A New Managed Service for Sustainability: EVORA’s New Solution to Support Investors

Real asset investors are under pressure to report more, prove more, and deliver more – often with fewer people and less time. That gap between disclosure and real change on the ground is exactly where EVORA’s Sustainability-as-a-Service (StaaS) sits. It is a partnership model where EVORA effectively becomes an extended part of your team, taking responsibility for the strategy, the data ingestion, the tooling and the execution that turns sustainability from a reporting exercise into visible value and business outcomes across the investment lifecycle.

EVORA is first to market with this multi-year managed service, giving investors a partner that takes full responsibility and delivers outcomes, instead of another short-term consultancy project, or complex tools that still need skills to operate in-house.

So what does that really mean in practice for an investment committee, an asset management team, or a stretched sustainability lead?

Bridging the Capability Gap Between Reporting, Action and ROI

For years, sustainability was often framed as a moral choice or a branding topic. That is not the conversation anymore; strong sustainability performance correlates with up to 25% higher returns, and LPs expect credible plans before they commit capital.

“The key problem we are solving is to enable clients to bridge the capability gap end-to-end between reporting, asset optimisation, and delivering return on investment”, says Carl Allen, EVORA CEO.

StaaS starts from a fiduciary duty lens. It takes the expectation that investors must protect value, manage risk and safeguard reputation, then folds sustainability into that responsibility, rather than treating it as a side project. It keeps conversations grounded in capital raising, valuation, and risk mitigation instead of abstract ambition.

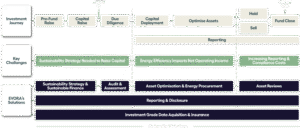

When you look at the investment journey for real asset investors – from pre-fund raise through capital deployment, operations and ultimately sale – you can see how sustainability decisions show up at every stage. StaaS is built to sit across that whole arc, not just at the reporting end. The organisations that succeed will be the ones that can convert sustainability from a narrative into a fiduciary responsibility-based operating system – something deeply embedded, data-rich and commercially grounded.

Why Internal Teams and Software Alone aren’t Enough

Most investors already know what “good” looks like. The problem is execution inside real constraints. Budgets are tight. Teams are shrinking. We’ve seen a trend where members of the team who arefocused in this space are reducing internally and not being replaced. The work has not gone away however, and investors still require business outcomes.

The work spans many specialised areas: meter-level data acquisition, landlord and tenant engagement, energy procurement, climate risk, due diligence, reporting frameworks, expert use of complex tooling, investor Q&A. One person with AI tools cannot deliver everything.

And even with the best of software, a platform on its own will not call your property managers, chase tenants for permissions, resolve the human bottlenecks that stop data flowing or interpret complex scenarios with real human expertise.

EVORA Sustainability as a Service brings together advisory, strategic consulting, technical expertise, tooling and data collection capabilities in one seamless, managed approach that takes away the problem.

An End-to-End Engine Across the Investment Lifecycle

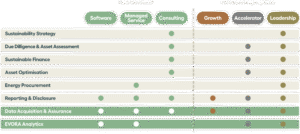

What makes StaaS different from traditional consulting is that it’s designed as an ongoing, multi-year managed service that delivers outcomes, not a series of disconnected projects and hard to understand tools. Clients plug into an integrated set of end-to-end capabilities: sustainability strategy, sustainable finance, due diligence, asset optimisation, energy procurement, and reporting and disclosure.

“We have listened carefully to the needs of the market. Clients don’t want to be bogged down and want to be freed up to deliver strategic end-to-end value for investors. EVORA is uniquely placed to take-on the accountability for the continuing challenge of delivery and be an extended part of the clients’ team. This enables the client to fulfil their fiduciary responsibility, whilst freeing up their time to focus on return on investment and business outcomes and to move from ambition to implementation. We work in partnership with clients to deliver the full packaged offering as a service from data collection, cleansing, validation, tooling, technology ecosystem, advisory services and specialist consulting expertise. We have the full trusted offering, end-to-end, which is very special in the market”, says Carl Allen.

Unlike pure software vendors, EVORA doesn’t hand over a “glossy front end” and expect your team to fix the inputs. Unlike traditional advisors, we don’t stop at the slide deck.

Across the investment lifecycle, that shows up in tangible ways. Access to capital improves because you go into fundraise and debt discussions with investor-ready data, clear strategies, and financing frameworks that stand up to scrutiny. During acquisitions, due diligence goes beyond a checklist to include better visibility on physical climate risk, future CapEx, and where value might erode if issues aren’t addressed. During hold, asset optimisation and energy work affect both operating costs and attractiveness to tenants.

Think of a building with tuned performance, energy coming from more secure and lower-cost sources, and a clear improvement plan. That’s a very different sales story at disposal.

For different levels of maturity, the StaaS packages – Growth, Accelerator, and Leadership – offer a clear starting point and a path to scale without constant renegotiation or internal hiring rounds.

From Indecision to Action

A lot of investors today know they need to move faster, but don’t know where to start. They worry about cost, team bandwidth, and picking the wrong first move. StaaS is built for that reality. You don’t have to switch everything overnight. You can start with a pilot, test how it works across a slice of the portfolio, then expand.

Day to day, the biggest change clients will feel by using the StaaS model is consistency. Rather than reinventing the wheel asset by asset, they tap into standard processes, templates, dashboards, tools, and methods that are already aligned to industry best practice. That saves money by avoiding duplicate vendors, avoids the need to recruit large internal teams, and hands time back to investment and asset managers so they can focus on deals and performance instead of wrestling with data.

“I’m excited about enabling our clients – helping them see what they can achieve at pace. I’d like to think this will reshape how investors think about sustainability and fundamentally change the narrative from activism to economics, but first it will help to reframe the conversation, provide capabilities and unlock outcomes. To this end, we offer a multi-year managed service, so clients are reassured this is being looked after by a partner that has all the tools, techniques, and experience to provide this service and business outcomes for the long term“, says Carl Allen.

Ultimately, Sustainability-as-a-Service is about enablement. EVORA takes responsibility for the heavy lifting – from the meter read to the investment memo – while you retain control of strategy and capital allocation. If you’re looking to reduce risk, protect asset value, and strengthen investor confidence over the next years, the question isn’t where to start, it’s how long you can afford to wait. The worstdecision is indecision.

If you’d like to see how StaaS could work for your portfolio, get in touch and we’ll talk through where you are today and what outcomes you want to reach.