SHARE

Thoughts

I’m sure by now you’ve heard about the new kid on the ESG reporting block – the Corporate Sustainability Reporting Directive, or CSRD. The CSRD was recently adopted by the European Commission as part of the European Green Deal to take over from the Non-Financial Reporting Directive (NFRD). It is a piece of legislation providing a sustainability reporting framework for companies with the aim of enhancing transparency and promoting standardisation in the sustainability reporting landscape.

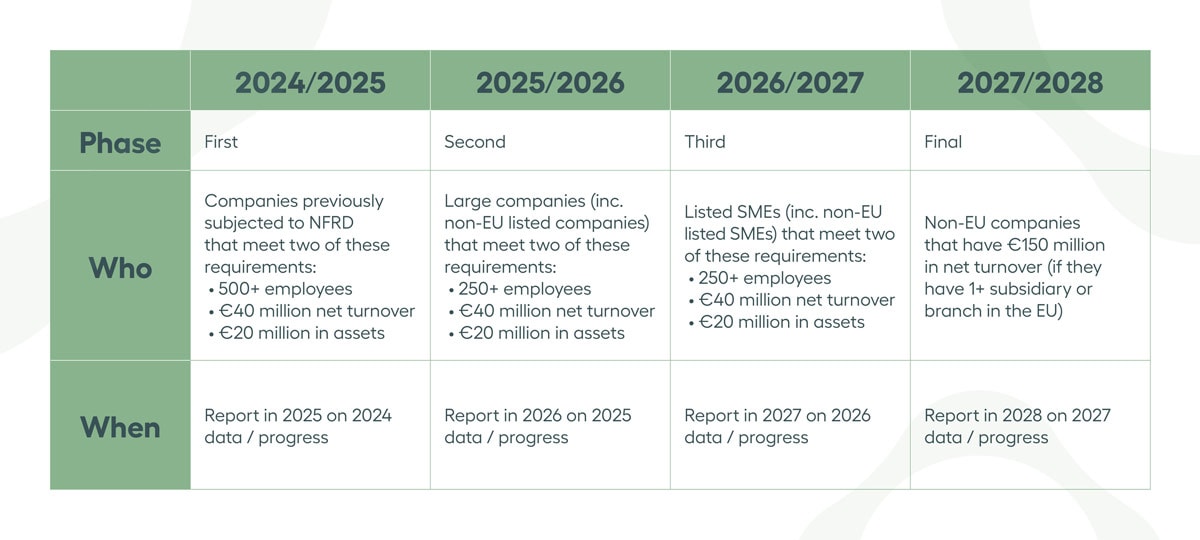

The CSRD is expected to capture significantly more companies than the NFRD did, so there are different compliance windows for companies of differing sizes and operating locations. This could mean that although your company may not be initially captured by the CSRD, it’s likely that over the next few years, we’ll see a shift in ESG reporting practices aligning more closely with the CSRD reporting framework.

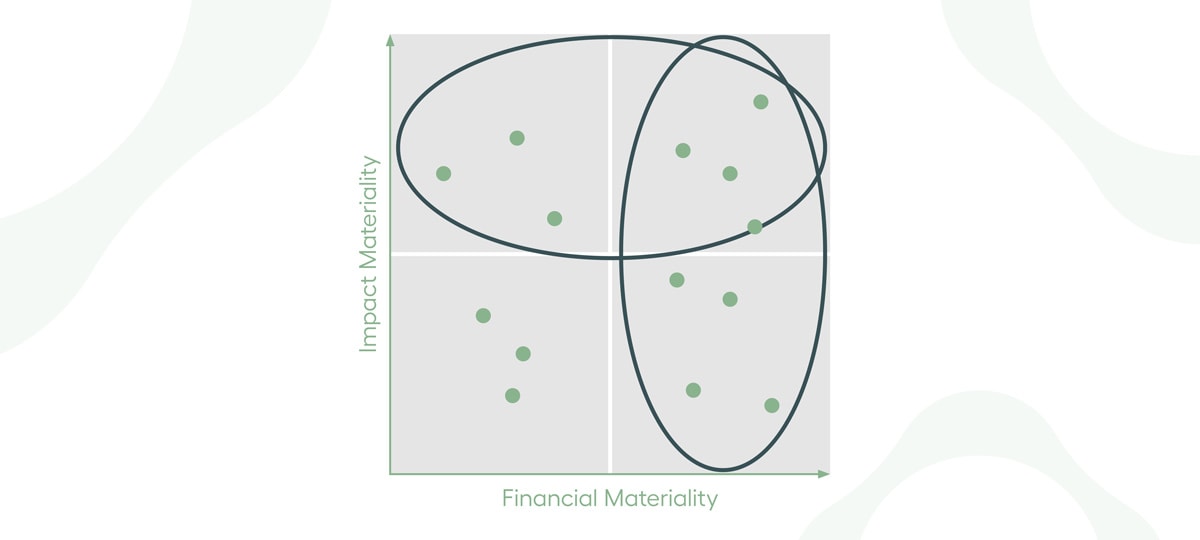

As part of the CSRD framework, we are presented with the European Sustainability Reporting Standards (ESRS) which are 12 general and topical standards that define disclosure requirements and data points. Within the ESRS, there lies a potential 1,144 qualitative and quantitative data points. I say potential because the requirement to report to the data points is based on the results of a Double Materiality Assessment which determines topics that are material to a company on both an impact basis, and a financial basis, looking at the ‘outside-in’, and the ‘inside-out’ effects of a company. The data points are therefore whittled down, requiring reporting on only the topics deemed to be material to your company.

At first glance, reporting under CSRD can seem rather overwhelming; there’s the Double Materiality Assessment which will be a new concept to many, with hundreds of data points to gather, analyse and report on, and then the process of having the report and methodologies used assured. Beginning the process of reporting according to the CSRD framework early is a key step however, as it allows the identification of any gaps in data points for material topics which would need to be reported on when it gets to the time that you must be compliant. This puts you ahead of the game and allows the establishment of clear processes to get your CSRD report over the line.

The CSRD is also very closely linked to other ESG reporting frameworks, and holds similarities with many familiar faces such as the Global Reporting Initiative (GRI), INREV Sustainability Guidelines and EPRA’s Sustainability Best Practice Recommendations. It’s likely that if you already report in alignment with one, or more, of these frameworks you’re already in a great position to report under CSRD.

Looking ahead, the requirements under the CSRD framework will not only enhance ESG reporting, it will also help you understand the key ESG-related risks and opportunities your company faces, enabling great opportunity to integrate ESG risk management even further into your overall business strategy.

The efforts towards standardisation will allow comparisons of ESG performance and progress against companies which operate in different locations, industries, and scales which is nearly impossible at the moment. Ultimately, the introduction of the CSRD is an important step in the world of ESG and has the potential to have a wide-ranging impact on consistent and comparable ESG reports.

At EVORA, we have dedicated ESG reporting specialists who have deep knowledge of ESG reporting frameworks, grounded in experience through working with our clients to improve their ESG reporting.

Contact us to explore how our industry-leading expertise and innovative solutions can help you in your journey to compliance with CSRD.