SHARE

Thoughts

Fund View is a powerful sustainability software tool that helps you manage reputational risk and engage with stakeholders. A single platform for visualising and enriching all asset data on fund-level dashboards, Fund View prioritises actions to optimise CapEx and OpEx for sustainable real estate.

Who benefits from Fund View, and how does it support sustainability?

EVORA Global purpose-built its SIERA sustainability software to deliver a seamless user experience for property, asset, fund, and ESG managers. Our new Fund View software feature provides a comprehensive view of your entire fund portfolio for effective teamwork on one secure, accessible sustainability platform.

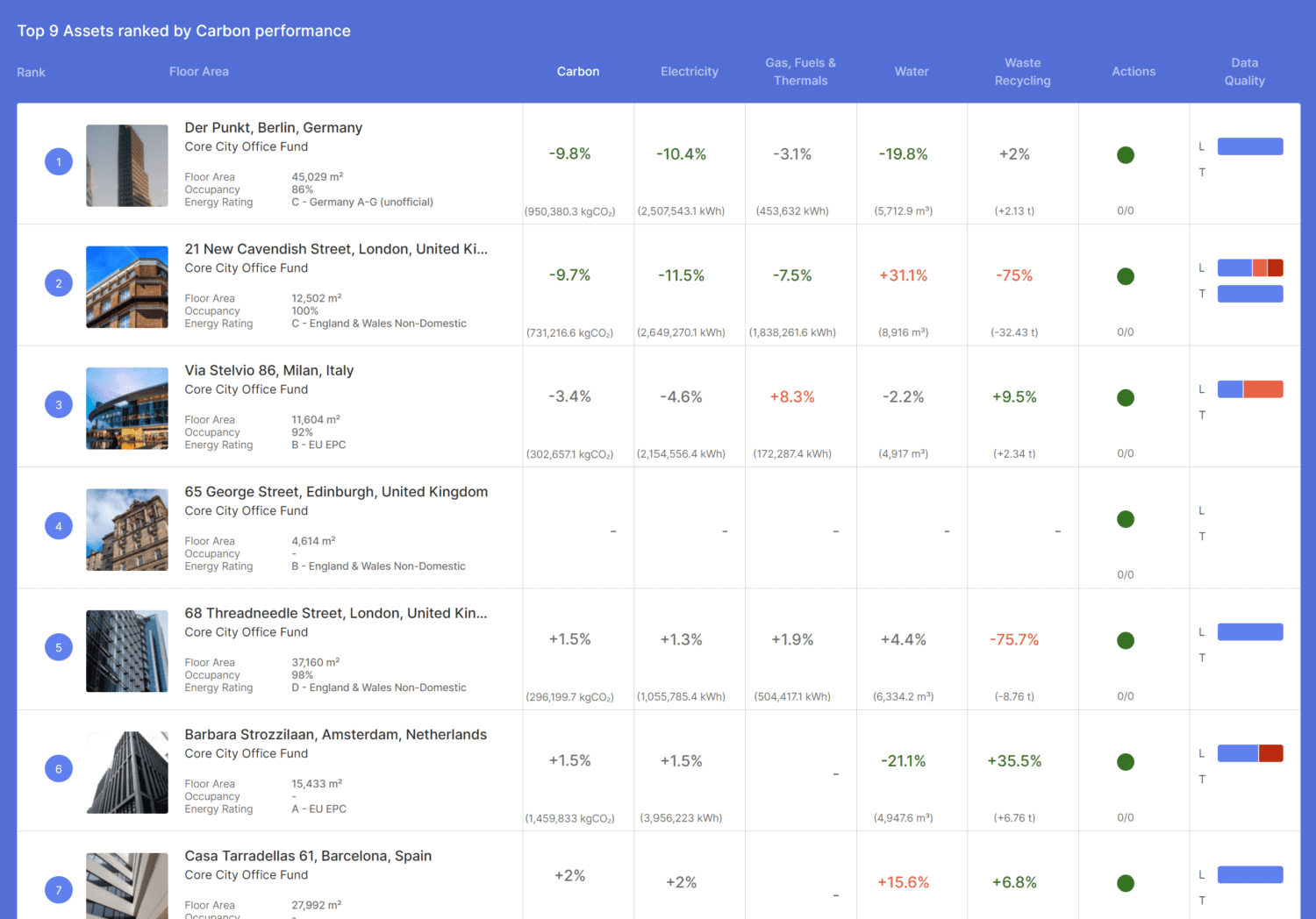

Fund View tracks and compares sustainability data for all your funds against set targets, helps you assess the sustainability ranking of each fund, identifies potential issues and opportunities for improvement, and recommends actions to optimise the operational performance of each fund.

Together with SIERA’s single login, Fund View streamlines your fund management activities to make your workday easier and simpler. Rather than juggling multiple logins for separate sources and systems, your property, asset, and investment teams can now collaborate to make fast data-driven decisions and construct strong business cases for resilient sustainable real estate portfolios. So, how does Fund View work in practice?

How does Fund View drive sustainable real estate?

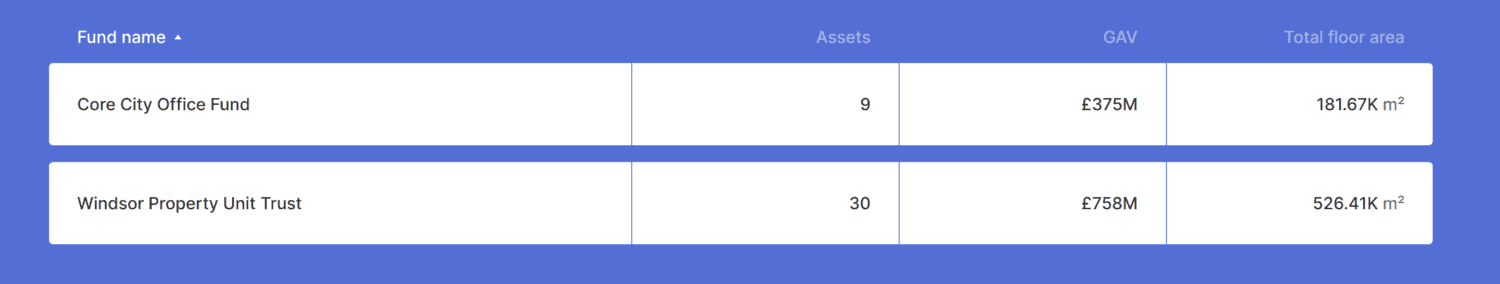

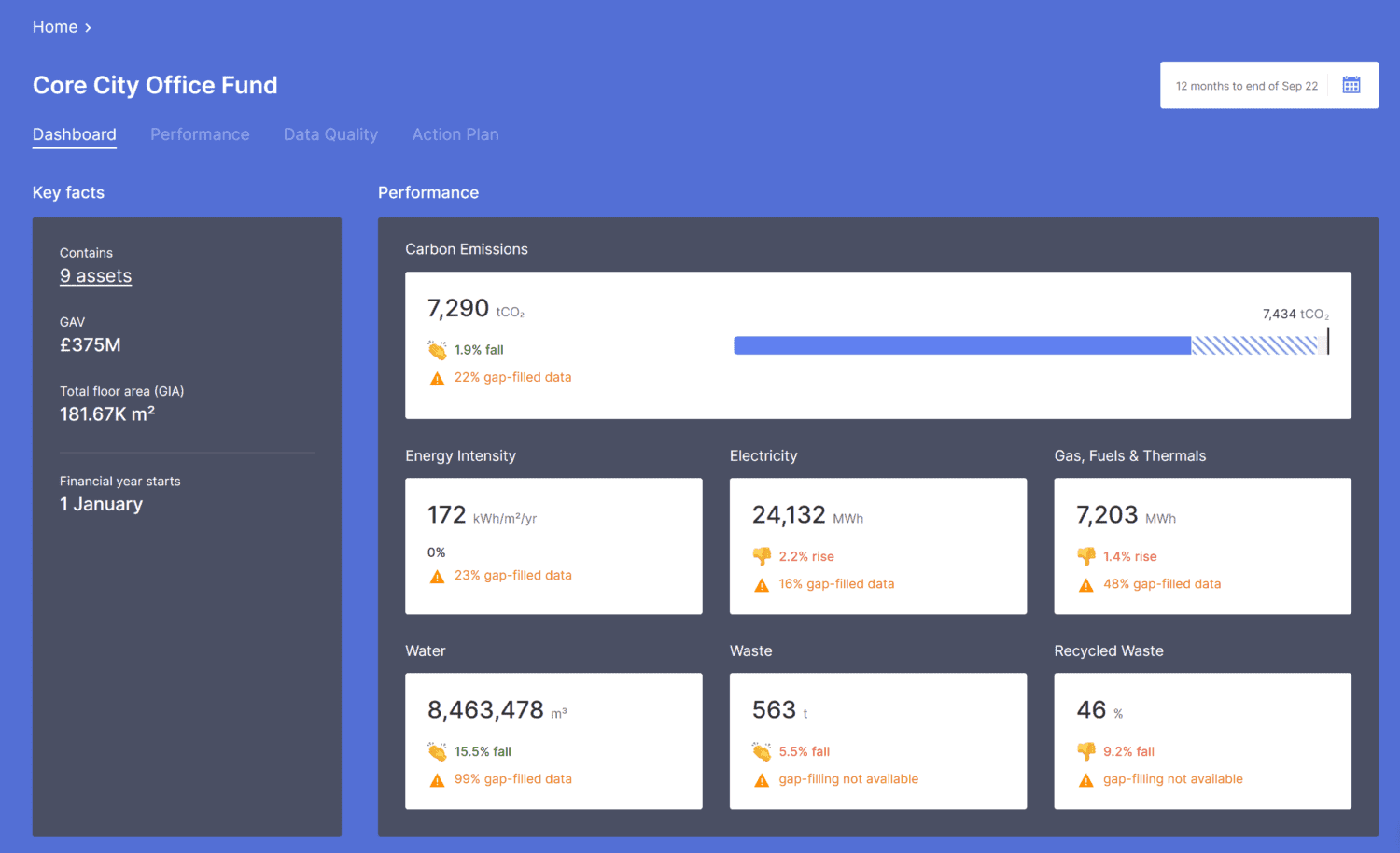

Our user needs drive Fund View. By listening to the challenges faced by our existing SIERA users, we’ve developed new features to support financial decision-making for stronger sustainability performance. Your customised Fund List ‘home page’ summarises key facts about each fund you manage. From here, you can easily navigate to individual Fund Dashboards to check your sustainability outlook on visual cue cards.

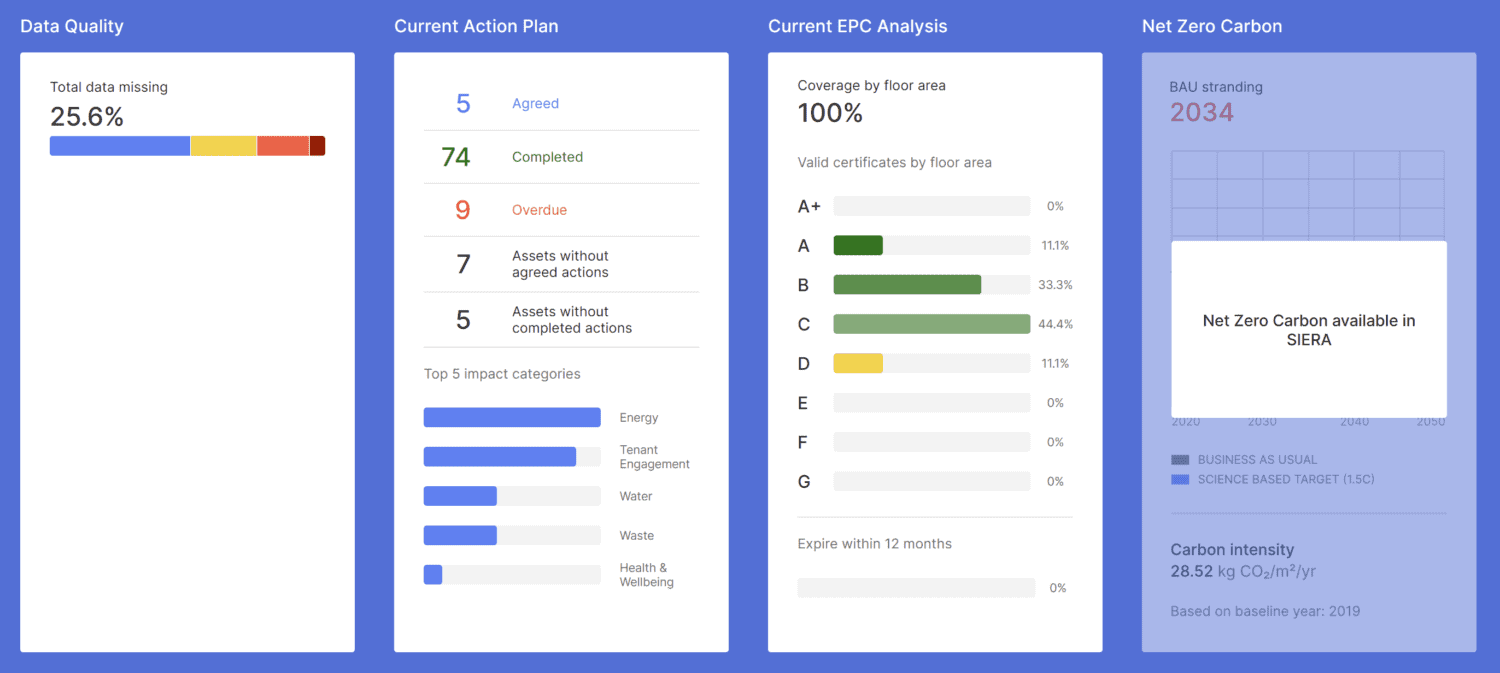

Fund View helps you track and manage the sustainability performance of your real estate funds by improving asset Performance, pinpointing low Data Quality, setting targeted Action Plans, and facilitating regulatory compliance, with alerts for Energy Performance Certificates set to expire within 12 months. Combined, these capabilities enable your team to take charge of sustainability risk factors and unlock emerging opportunities to avoid value erosion. Stay vigilant!

Our forthcoming Net Zero Carbon feature is coming to Fund View soon, so you can track progress against net-zero commitments at fund and asset level and lead the way in sustainable real estate investments.

How does Fund View allow you to explore the data?

Although thesehandy Information Cards present accessible visual summaries, the real benefit comes from taking a deeper dive into each topic. You can select any card of choice to discover more detailed data insight on your fund’s personalised Data Quality, Action Plan, and Performance dashboards. This reduces information overload, simplifies your user experience, and enables you to focus on the most business-critical objectives for each individual asset to benefit your entire fund. Here’s how.

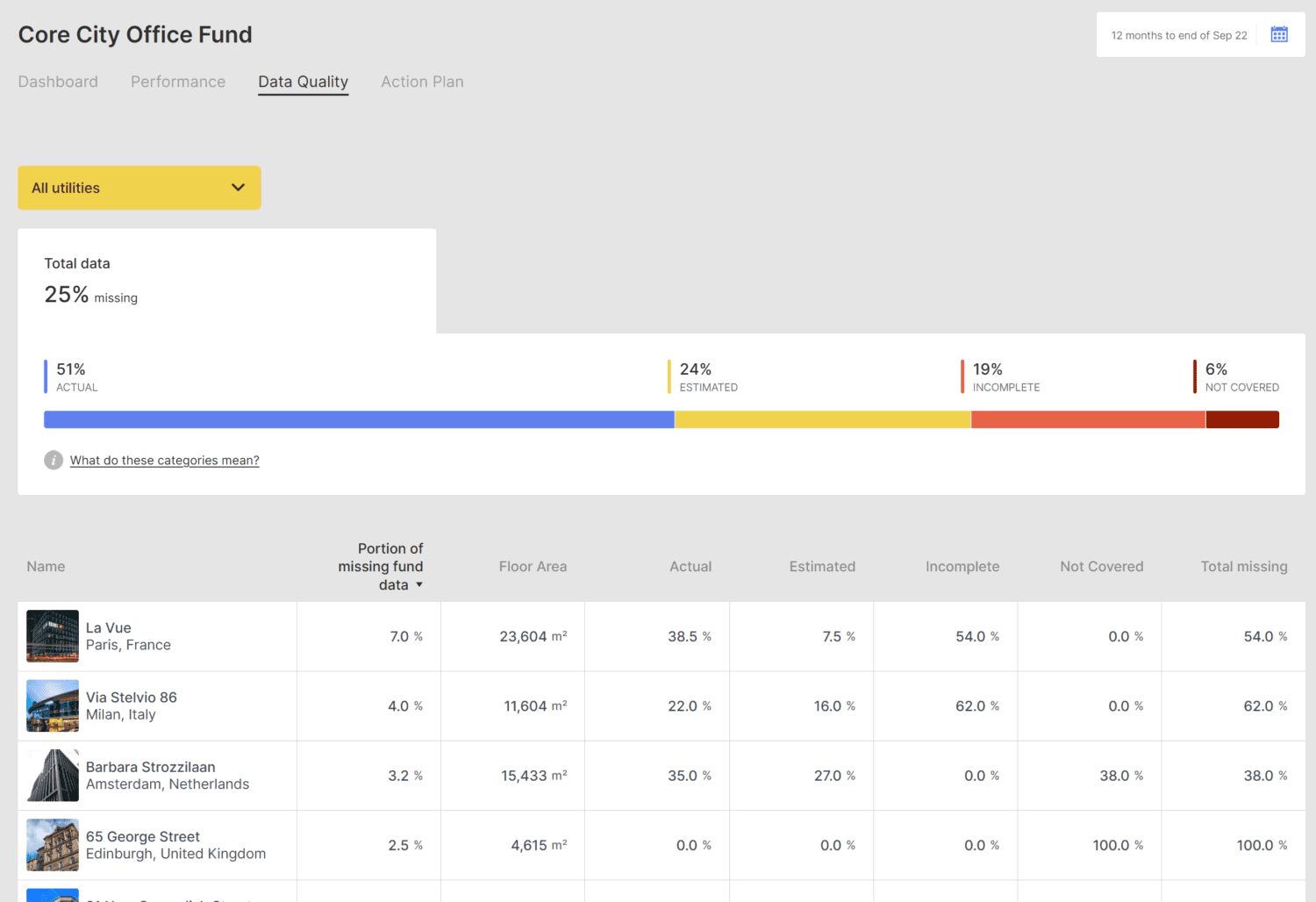

How does the Data Quality dashboard benefit your fund?

Data Quality presents a detailed overview of the quality of energy consumption data for each asset in your fund. This helps you easily spot any missing or weak points in the data for your fund, so you can take steps to enhance your asset data collection to maximise its effectiveness. Collecting consistent high-quality energy consumption data across all your assets not only supports your financial decision-making and enhances the sustainability performance of your fund, but transparent sustainability data is also key for credibility and compliance, while ensuring more effective communication with stakeholders.

Fund View clearly signposts any missing data or instances where an asset’s floor area has no data coverage to alert you to prioritise action. You can also easily identify which utility and/or floor space generates the most significant data quality issues to help target your data management actions. Your most ‘problematic asset’ sits front and centre at the top of your Data Quality list, because improving data quality for this asset will generate the greatest result for your entire fund. It’s the one to watch.

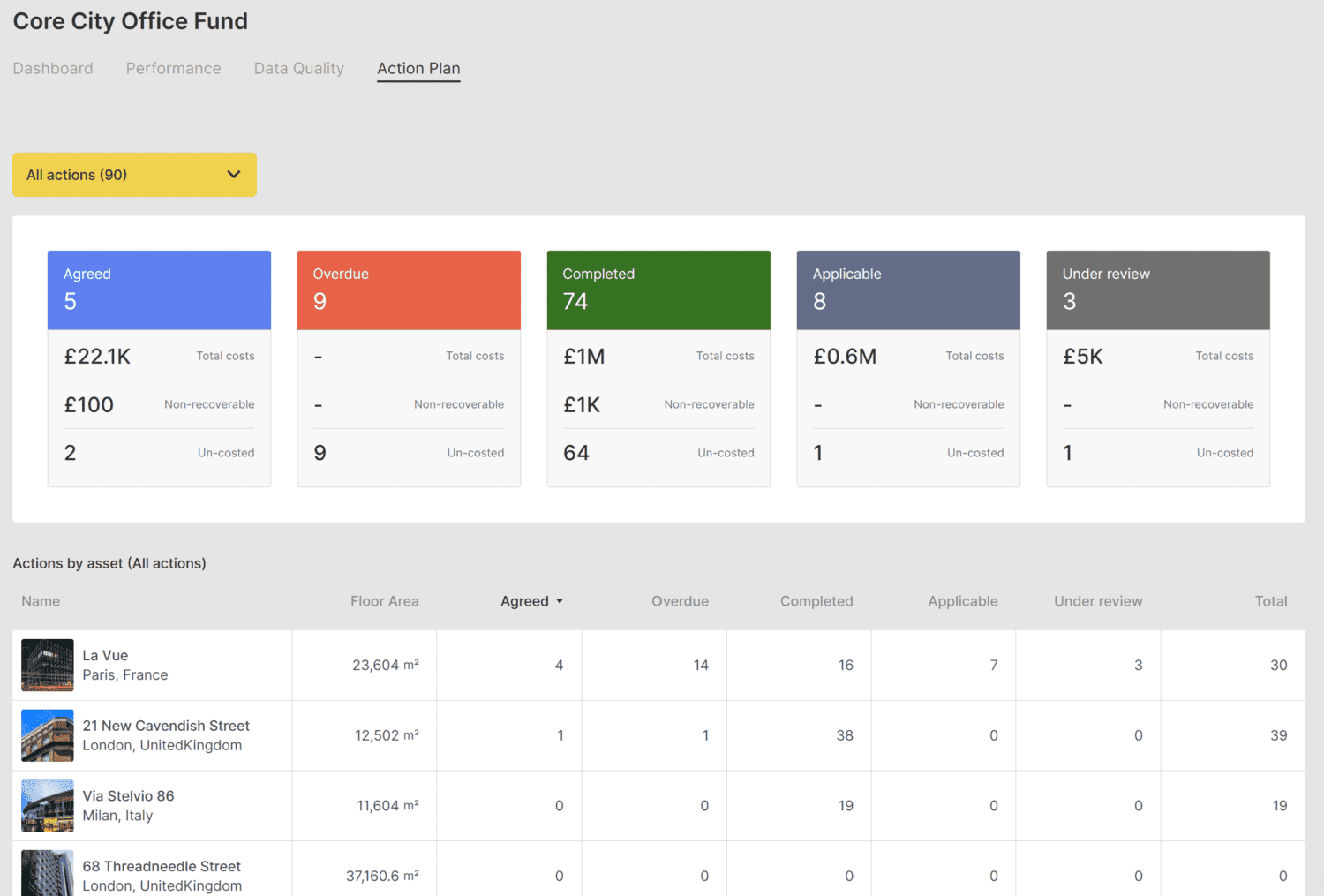

How does the Action Plan dashboard benefit your fund?

To implement a successful sustainability strategy, reduce any potential risk factors, and be able to report on how these risks are being managed, you need to put in place Action Plans for each asset.

Targeted actions to improve the sustainability performance of your fund need to be set and routinely adjusted. Keeping track of improvements, financial costs and target due dates are must-haves for your energy consumption, waste generation and recycling, and carbon emissions.

Fund View’s Action Cards help you monitor which activities are in progress, whether there’s any inactivity threatening to stall your progress, and present clear reminders to secure approvals or conduct viability assessments before taking further action. Action Plans also display relevant financial costs and can be updated to reflect new decisions and priorities impacting on the investing plans for each fund.

It’s important to note that Action Plans correspond to a broad range of categories potentially affecting your fund performance: biodiversity, building performance, community engagement, energy, governance recommendations, health and wellbeing, social value, tenant engagement, waste, recycling, and water. Nothing is left to chance.

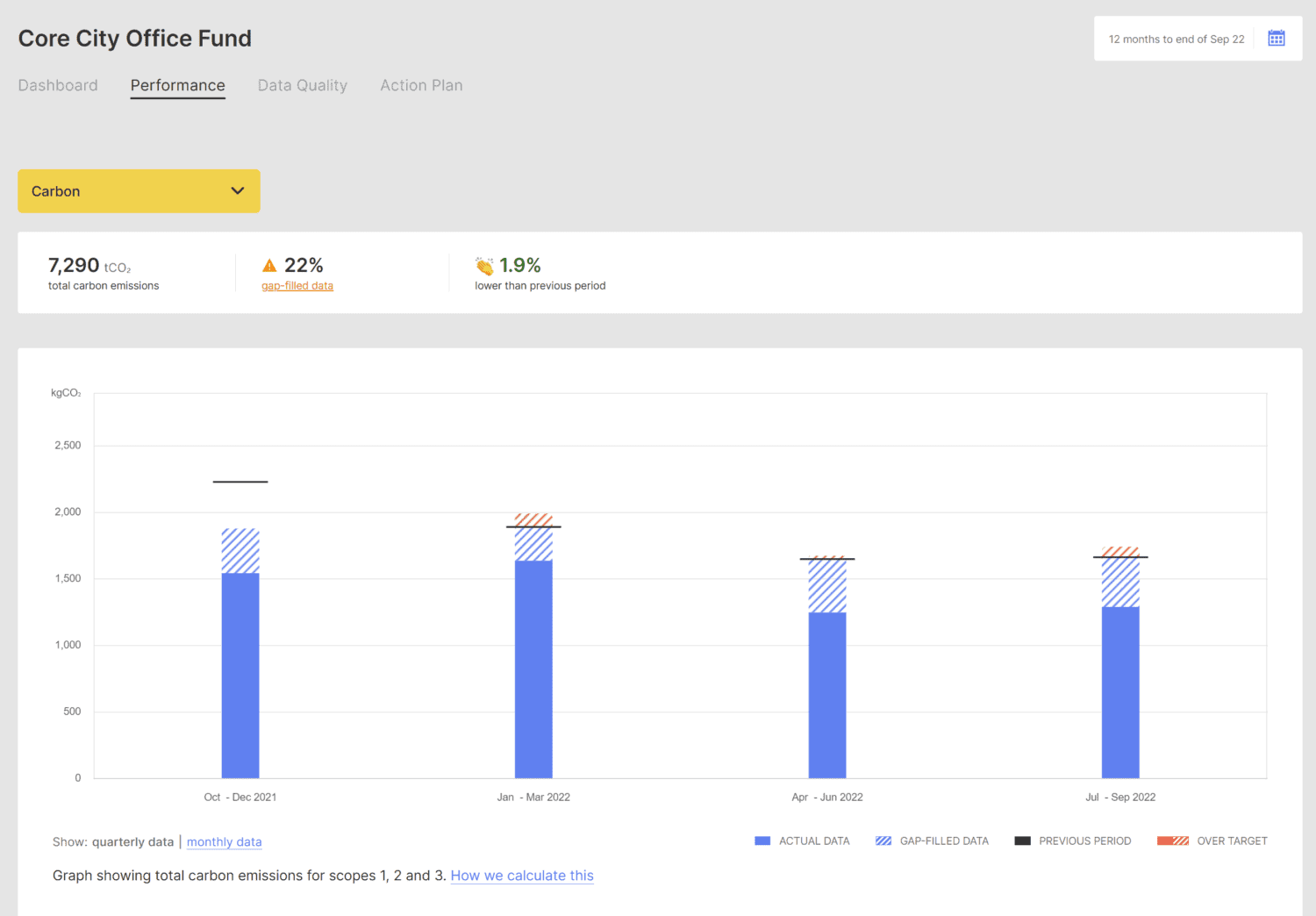

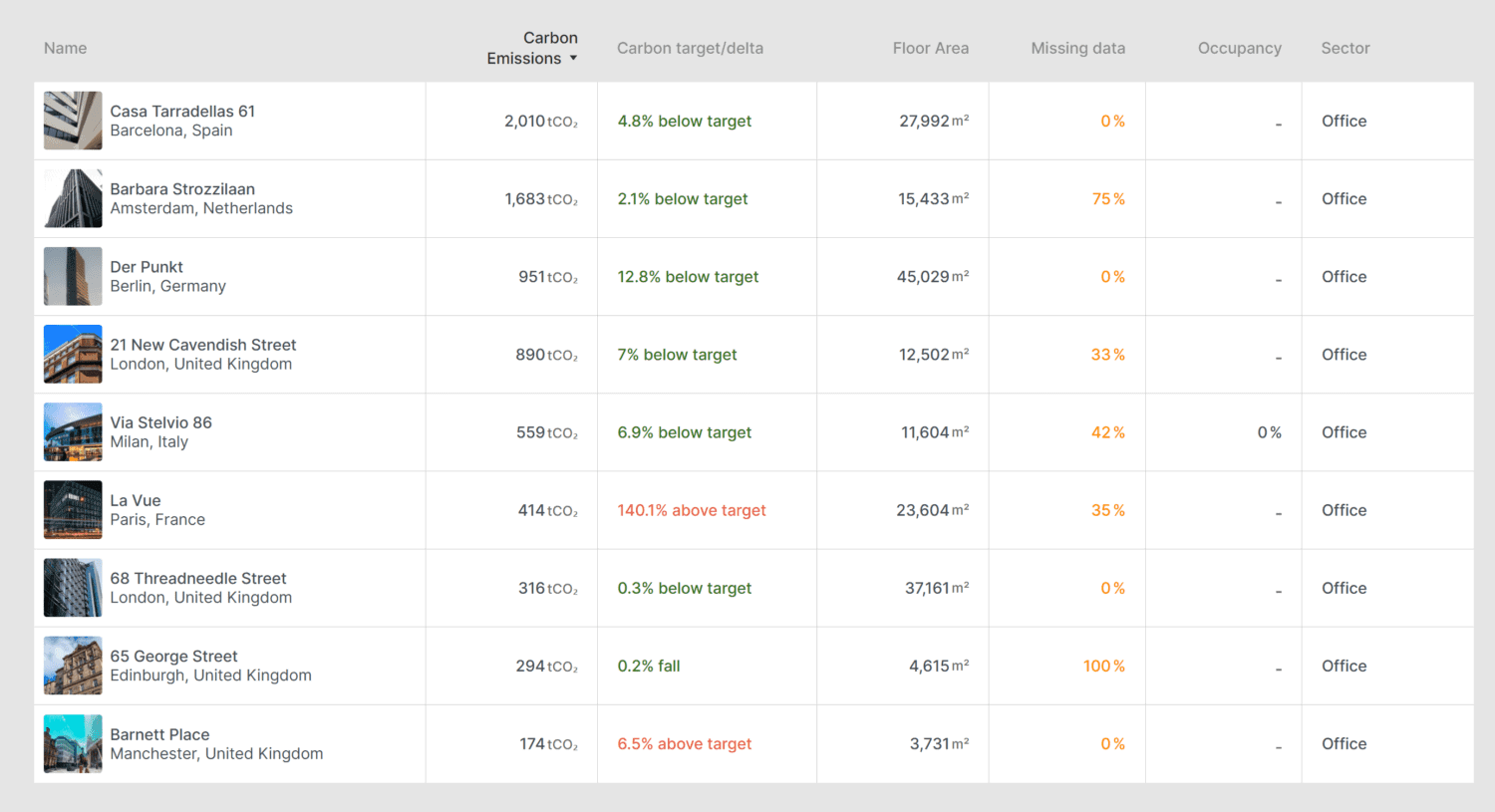

How does the Performance dashboard benefit your fund?

Your Performance dashboard reveals three key data insights that shine a light on the accuracy of your Data Quality – and how near you are to achieving targets set in your Action Plan.

- Actual and supplier-estimated consumption data

- Automated calculations for carbon emissions data (covering your fund’s total carbon footprint: Scopes 1 to 3)

- Any missing data gap-filled from comparable indicative data

Although less accurate, estimated data is better than no data when it comes to measuring your Performance against set target reductions in your Action Plan, or for a specific timeframe in the current year compared with the same timeframe in the previous year.

By tracking progress towards set sustainability targets, such as energy and water consumption reductions, you can improve the sustainability Performance of your assets over time, identify where cost savings can be made, and increase the overall value of your real estate portfolio to attract more and more ESG-conscious investors.

How are funds ranked for Net Zero Carbon performance?

Ambitious net zero goals add credibility to your business if you deliver on your pledges. That’s why we’re developing Fund View to track your carbon emissions data and help measure the Net Zero Carbon performance of your fund. Visualisations will chart your data every month or quarter to periodically illustrate whether your carbon emissions are above or below set targets for each asset and, ultimately, your complete fund.

What’s next in store for Fund View?

Fund View keeps you updated on your energy and water consumption, sustainability Performance, Energy Performance Certificates, Action Plans, and Data Quality for all your funds. Next in store, SIERA’s Net Zero Carbon module will add even more valuable insight to support your investment funds. And take EVORA Global one step closer to achieving its vision of accelerating the evolution and adoption of real estate sustainability to enhance the wellbeing of the planet and its people.

Join our community to read about SIERA’s forthcoming Net Zero Carbon sustainability software release, plus insightful EVORA Global news and views.