SHARE

Thoughts

Earlier this month, BRE released the latest version of the BREEAM In-Use International Scheme, Version 6. The uptake of BREEAM In-Use assessments has increased significantly over recent years, so there is no doubt that the requirements of the new standard will have a wide-reaching impact.

With this in mind, let’s take a look at the headline changes below.

“Overall, the bar to achieve ratings has well and truly been raised, so it’s important these changes are fed into BREEAM In-Use Improvement Programmes as early as possible.”

Removal of Part 3

In the BIU 2015 scheme, Part 3 (Occupier Management) required considerable tenant engagement and was rarely assessed. BRE have therefore only included Part 1 (Asset Performance) and Part 2 (now called “Management Performance”) in the scheme.

New Categories

Resources category combines issues from the Materials and Waste categories of the BIU 2015 manual bringing together circular economy principles.

Resources category combines issues from the Materials and Waste categories of the BIU 2015 manual bringing together circular economy principles.

Resilience category considers an asset’s physical, social and climate change risks and has improved BIU 2015 elements on natural hazards, durability, security and climate related risk management.

Resilience category considers an asset’s physical, social and climate change risks and has improved BIU 2015 elements on natural hazards, durability, security and climate related risk management.

Minimum Standards

Previously only in Part 3, minimum standards are now in place for Part 1 and Part 2. Note that for Part 2 a sustainable procurement plan (Rsc 05) and fire risk assessment (Rsl 09) is required to achieve any rating, a significant change.

Previously only in Part 3, minimum standards are now in place for Part 1 and Part 2. Note that for Part 2 a sustainable procurement plan (Rsc 05) and fire risk assessment (Rsl 09) is required to achieve any rating, a significant change.

Exemplary Credits

Introduction of exemplary credits can be achieved for performance levels beyond what is recognized by standard criteria and are each worth 1% (regardless of the category weighting) to the overall score (up to 10% boost capped at 100%).

Introduction of exemplary credits can be achieved for performance levels beyond what is recognized by standard criteria and are each worth 1% (regardless of the category weighting) to the overall score (up to 10% boost capped at 100%).

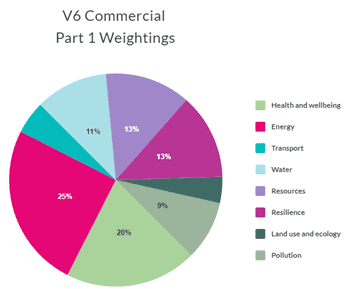

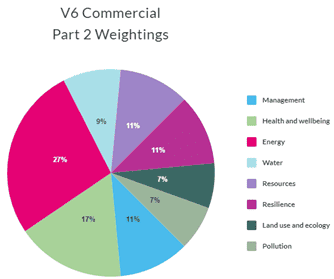

Notable Changes to Weightings

- % decreases were seen in Land Use and Ecology, Transport, Pollution, Management, Energy

- % increases were seen in Health and Wellbeing, Water, Materials and Waste

Weightings are now as follows:

Integration of Key ESG Topics

- Alignment with TCFD e.g. Rsl 06 Emergency plans and climate-related physical risks and Rsl 07 Climate-related transition risks and opportunities.

- Social value focused e.g. Rsl 08 Social risks and opportunities considers the wider risks and opportunities for the asset. These include social disruption, public health (such as pandemics), poverty, and forced labour.

- Greater context to UN SDGs provided across a number of categories e.g. Goal 3 (Good Health and Wellbeing) under ‘Health and Wellbeing’, Goal 6 (Clean Water and Sanitation) under ‘Water’, Goal 7 (Affordable and Clean Energy) under ‘Energy’, Goal 11 (Sustainable Cities and Communities) under ‘Transport’ and ‘Resilience’, Goal 12 (Responsible Consumption and Production) under ‘Resources’, Goal 15 (Life on Land) under ‘Land Use and Ecology’.

- A route to Net Zero certification may be possible for assets that achieve 50/50 in the energy section. This section takes the operational CO2e intensity of an asset and compares it against the relevant ‘Reference Benchmark’ CO2eq emissions (established by BRE) using a sliding scale, with a maximum of 50 credits being awarded for a zero carbon building, and 0 credits awarded where the assessed emissions are more than four times the ‘Reference Benchmark’ emissions. An additional five exemplary credits are available for buildings that are carbon positive.

Greater Emphasis on Performance

- Credits now awarded for the completion of energy audits (ENE 22) and reduction of carbon emissions over time (ENE 24).

More Flexibility in Achieving Credits

- A note has been added to each of the evidence requirements in each issue to allow for a wider range of acceptable evidence types e.g. assessors’ own site inspection report, communication records, documented interviews.

- Land Use and Ecology use was rarely a section when you could score high due to limitations with inner city assets, but it now allows the enhancement of ecological value offsite (within 2km e.g. local park).

Certification Process

- There are no more renewals required each year in between the three year recertification period; each certificate will be issued with a three year expiry date. Note assessments on the old scheme will still need to be renewed.

- The survey remains open post submission/certification and answers can be changed at any time in the middle of the three-year cycle without re-certification. This includes adding a new Part to certification which will not reset the three-year cycle.

- Certification fees are only required if you make significant changes (≥10% change to score) or want to recertify with a new score. Mid-cycle submissions can be made up to 10% of the score via desk-based audit, anything more will be treated as an initial certification and will require a site visit. Note that mid-cycle submissions will not reset three-year expiry dates.

Transition Period

- Up until 4th May 2021, it is still possible to register assets on the 2015 scheme. Assets will then have one year to complete the assessment and a further three years to transition to the V6 scheme. There can therefore still be assets on the 2015 scheme up until May 2025, though the vast majority would have transitioned long before then.

- Assets currently assessed under the 2015 scheme will be able to wait until recertification is due (after three years from initial certification) before needing to make the leap to V6. The earliest an asset would have to transition is May 2021 if initial certification was achieved in May 2018.

Eligibility Criteria

- Stricter occupancy requirements for Part 2 – ≤20% of the GIA can be classified as ‘vacant’ over the reporting 12 month period.

- More clarity for Part 1 – ≤20% of the GIA can be classified as ‘unfitted’ at the point of submission.

- Relaxed eligibility criteria for multiple building single assessments – the removal of “Connected to and share common services” requirement has been replaced with “All buildings must be located on the same site”.

- For assets residing in other National Scheme Operator (NSO) regions (e.g. Germany, Austria, Netherlands, Spain, Norway, Sweden), they will be updating their own schemes later this year, closely aligning to the V6 scheme.

Overall, the bar to achieve ratings has well and truly been raised, so it’s important these changes are fed into BREEAM In-Use Improvement Programmes as early as possible. There are of course many other minor changes that our BREEAM assessors and consultants are getting to grips with, but the feedback from the team so far has been very encouraging. We believe BRE have done a phenomenal job in driving positive change, and encapsulated many of the key ESG issues the real estate market faces today.